Mar 3, 2023

This Week in China: Xi Has a Shot at Restoring Market Confidence

, Bloomberg News

(Bloomberg) -- China investors limped into March calling the end of the reopening trade, trimming bullish positions and lamenting that the market was in need of fresh catalysts this soon into 2023.

While plenty of hedge funds pulled out, those who stuck around were swiftly vindicated. Blowout economic data this week showed the country’s recovery from Covid Zero has been far faster than anticipated, juicing stocks and the yuan. The rapid gains showed just what happens when a convincing catalyst hits a market full of unconvinced traders.

Does this mean the China bulls are back in charge? Not quite. Mistrust of President Xi Jinping is running high and many investors are de-risking before China’s legislature — the National People’s Congress — meets for its annual session that starts Sunday, as I wrote here.

There’s a spirited debate right now on whether Xi’s continued consolidation of power will be good or bad for markets. One view has it that unopposed strongmen surrounded by loyalists tend to make policy mistakes. Another take is that cohesion at the top speeds up pragmatic policymaking and helps push through difficult but necessary change.

Here’s my roundup of the week’s key developments for China markets.

Economic boom

China’s post-Covid recovery is surprising even Beijing’s top officials. February data showed factory output recovered at the fastest rate in a decade, while home sales rose for the first time in 20 months. This will likely reduce the need for more economic stimulus at the NPC meeting.

- China Leaders Said to Be Surprised by Pace of Economy’s Rebound

- China’s Factory Activity Tops Decade High, Boosting Recovery

- China Home Sales Rise for First Time in 20 Months on Policy Aid

Power consolidation

Xi is preparing to further consolidate power. Recent speeches suggest the Chinese president and his close allies will have an even greater say in managing the country’s economy and oversight of private business. Meanwhile, Xi faces a more skeptical public at home.

- Xi Boosts Party Control of China’s Economy With Sweeping Changes

- What Wall Street Gets Wrong About Xi Jinping’s New Money Men

- Xi Faces More Doubts Within China as Global Problems Mount

China-US tensions

Lawmakers in Washington keep looking for ways to decouple the US from its rival, portraying threats from all aspects of China’s leadership, military and economy. US and Chinese defense officials haven’t spoken since November, while American companies in China are turning increasingly negative about the outlook for the domestic market.

- China-Bashing Is One Thing a Divided US Congress Can Agree On

- Top US, Chinese Defense Officials Haven’t Spoken in Three Months

- US Firms Turn More Negative on China as Economy, Tensions Bite

Banker summoned

A well-connected dealmaker is being detained by China’s antigraft investigators, the Wall Street Journal reported. Bao Fan’s sudden disappearance in February has unnerved China’s business elite and rocked the finance industry. Bankers in China are being told to clean up their “hedonistic” lifestyles.

- China’s Top Tech Banker Detained by Antigraft Agency, WSJ Says

- China’s Top Tech Banker Is Missing? What That Means: QuickTake

- China Warns ‘Hedonistic’ Bankers to Toe the Communist Party Line

Chip mavens

Big-name Chinese internet moguls like Tencent Holdings Ltd.’s Pony Ma and Baidu Inc.’s Robin Li have vanished from this year’s list of delegates at the NPC, replaced by chip researchers and engineers. That’s another blow to the standing of high-profile entrepreneurs, and underscores Beijing’s focus on winning the tech race with the US.

- China Dumps Internet Moguls for Chip Mavens in Senior Ranks

- China Plans to Inject $1.9 Billion Into Top Memory Chipmaker

Global supplies

China’s lithium mines are being inspected for alleged environmental violations. This effectively shut down about a 10th of the world’s supply for the metal used to make batteries. Separately, China is investing big in heavily-polluting coal plants to secure energy supply.

- China Lithium Probe Shuts Down a 10th of Global Supply

- China Approves New Coal Power With Capacity of Entire UK Fleet

Evergrande limbo

China Evergrande Group has yet to agree on a restructuring framework with creditors — and the clock is ticking. That means the developer at the center of China’s property crisis could end up in liquidation. Its winding-up petition is set for a March 20 court hearing in Hong Kong.

- Evergrande Fails to Win Creditors’ Support as Key Dates Loom

... and three things to watch for next week

- Economists expect Premier Li Keqiang — who will deliver his last government work report at the NPC on Sunday — to set this year’s economic growth target at more than 5%.

- Two giants will report results: JD.com Inc. and Contemporary Amperex Technology Co. Ltd. — the battery maker known as CATL.

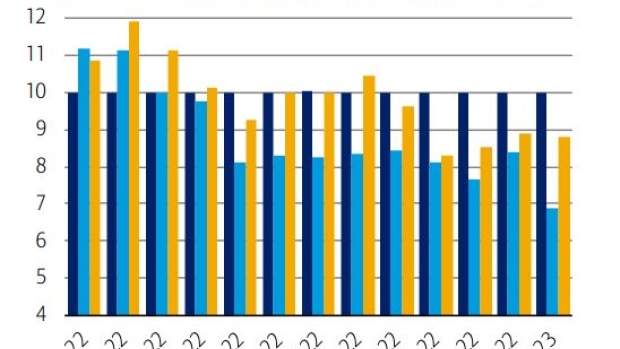

- Short positions on the offshore yuan are being rapidly unwound after China’s strong economic data surprised virtually everyone. Let’s see whether there’s a follow through from long-only investors after the NPC. Funds significantly reduced their exposure to China fixed income and FX in January — as this chart from Bank of America Corp. strategists shows.

©2023 Bloomberg L.P.