May 23, 2018

Tiffany sales blow away estimates as customers come back

, Bloomberg News

Tiffany & Co.’s revamp is starting to pay off.

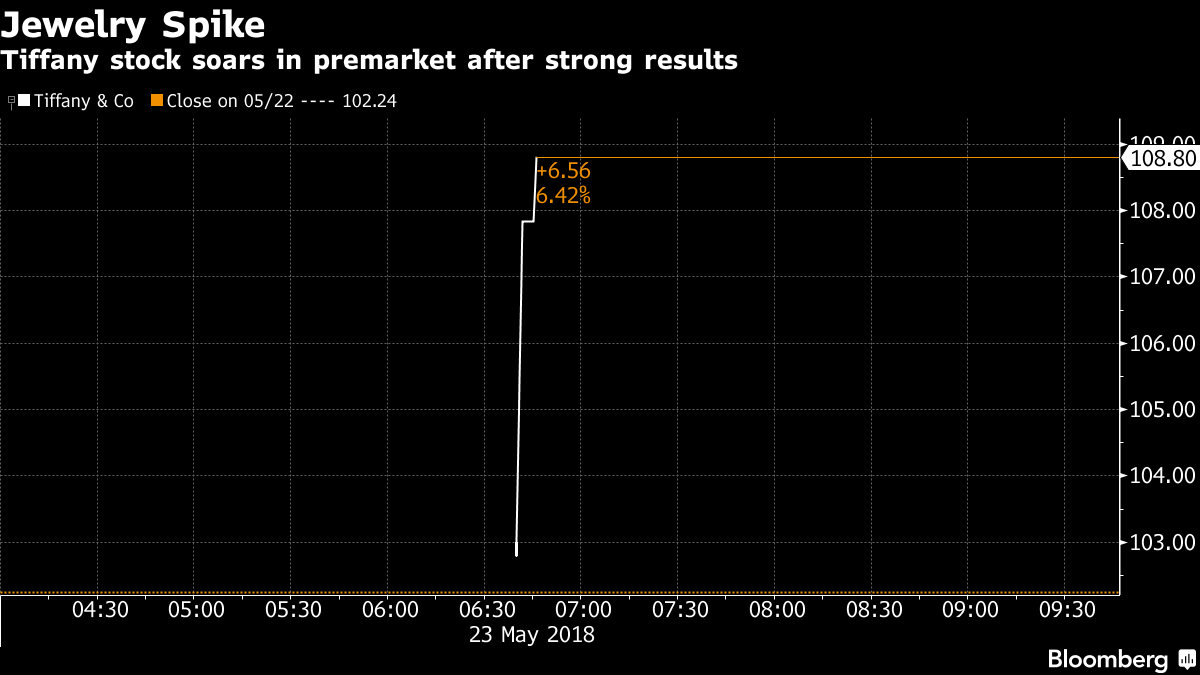

On Wednesday, the jeweler posted strong sales growth for last quarter, raised its profit forecast for the year and announced a share buyback plan of US$1 billion. Worldwide same-store sales, a key retail metric, blew away analysts’ estimates last quarter, led by gains in North America and Asia. The shares jumped 7.8 per cent in early trading.

Chief Executive Officer Alessandro Bogliolo is overhauling Tiffany to reverse a long sales slide. Hired last year, the former Diesel executive aims to woo a younger clientele by refreshing jewelry lines as he looks to generate hype for a 181-year-old brand that had grown stale. The revitalization attempt includes redesigned stores and back-end improvements in procurement and technology operations.

Global same-store sales climbed 7 per cent when holding currency constant, compared with the 2.6 per cent growth projected by analysts, according to Consensus Metrix.

Bogliolo’s jewelry renewal is just getting under way. Shoppers got their first look at creative chief Reed Krakoff’s debut jewelry collection on May 1. The former top designer at handbag label Coach released a line of platinum bracelets and diamond necklaces that came with price tags from $2,500 to $790,000.

Tiffany has often relied on hit products to drive sales, but older styles from designers like Elsa Peretti and Paloma Picasso have remained top attractions rather than new lines. Krakoff hopes to change that.