Dec 12, 2018

Tim Nash's Top Picks: Dec. 12, 2018

Tim Nash, founder of Good Investing

Focus: Green stocks and ETFs

MARKET OUTLOOK

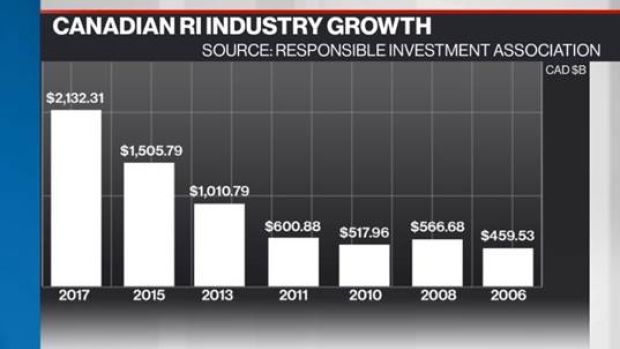

2018 will go down as the year sustainable investing awoke in Canada. After decades of being lulled into the illusion that investing ethically leads to a lower performance, smart investors are finally waking up to the connection between sustainability and profitability. Growth in assets under management has skyrocketed to more than $2 trillion.

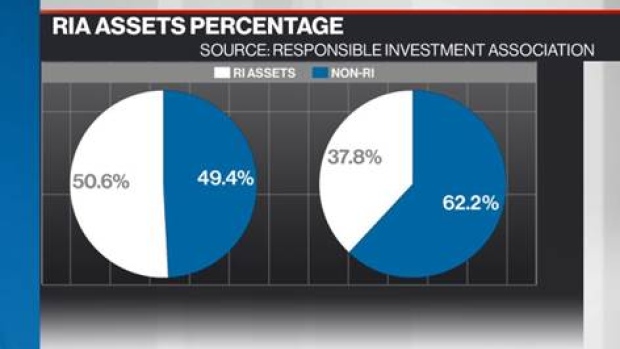

According to the 2018 Canadian Responsible Investment Trends Report, more than half of all assets in Canada are now aligned with one or more responsible investment strategies.

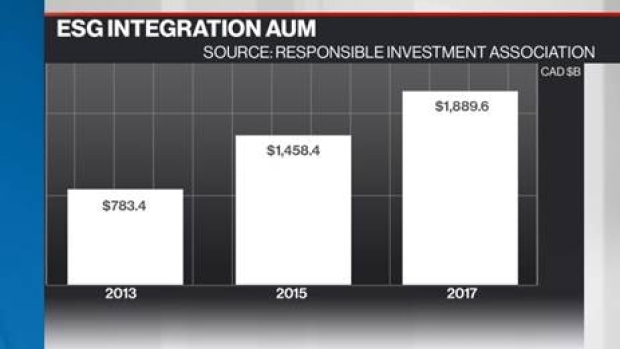

Not surprisingly, the most popular strategy is the one with the strongest correlation to outperformance; it's called the environmental, social and governance (ESG) integration. The “smart money” like the Canadian Pension Plan (CPP), the Ontario Teacher’s Pension Plan (OTPP) and Alberta Investment Management Corporation (AIMCO) have all integrated sustainability analysis into their investment process.

I’m encouraged that all the major pension funds in Canada are moving in this direction, but my fear is that retail investors are missing the boat. Brokers and advisors are badly misinformed and aren't responsive to investors who want sustainable investment options. Many firms now offer socially responsible options, but growth in assets have been much slower than I would expect given that performance has been just as good as the traditional funds.

TOP PICKS

CHANGE FINANCE US LARGE CAP FOSSIL FUEL FREE ETF (CHGX.N)

This ETF has a similar profile to the S&P 500 while being both fossil fuel free and socially responsible. It omits companies operating in the oil, gas, coal, military and tobacco industries in addition to excluding companies that fail to meet minimum standards relating to environmental and social issues.

ISHARES MSCI GLOBAL IMPACT EFT (SDG.OQ)

This is the first ETF that track the UN's Sustainable Development Goals. It includes companies that derive more than 50 per cent of revenues from products and services that are directly linked to themes such as basic needs, empowerment and climate change.

UNIVERSAL DISPLAY CORP (OLED.O)

Universal Display licenses their patented lighting technologies to the major technology companies like Apple and Samsung. With only about 10 per cent of market share currently, this company is very energy efficient and is an integral part of lowering energy consumption while improving display quality.

| DISCLOSURE | PERSONAL | FAMILY | PERSONAL/FUND |

|---|---|---|---|

| CHGX | N | N | N |

| SDG | N | N | N |

| OLED | N | N | N |

PAST PICKS: SEPT. 4, 2018

ISHARES MSCI ACWI LOW CARBON TARGET ETF (CRBN.O)

- Then: $118.83

- Now: $109.19

- Return: -8%

- Total return: -8%

ISHARES GLOBAL WATER INDEX ETF (CWW.TO)

- Then: $34.73

- Now: $33.00

- Return: -5%

- Total return: -5%

HANNON ARMSTRONG (HASI.N)

Hannon Armstrong has been remarkably resilient in the recent downturn. The company has seen tremendous year-over-year growth and is in a great niche as the world continues to recognize the risks of climate change and move to mitigate the impacts.

- Then: $21.42

- Now: $23.10

- Return: 8%

- Total return: 10%

Total return average: -1%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| CRBN | N | N | N |

| CWW | Y | N | Y |

| HASI | N | N | N |

TWITTER: @timenash

WEBSITE: https://www.goodinvesting.com/

BLOG: https://www.sustainableeconomist.com/