Apr 27, 2023

Tokyo Inflation Speeds Up, Focusing Attention on BOJ Price View

, Bloomberg News

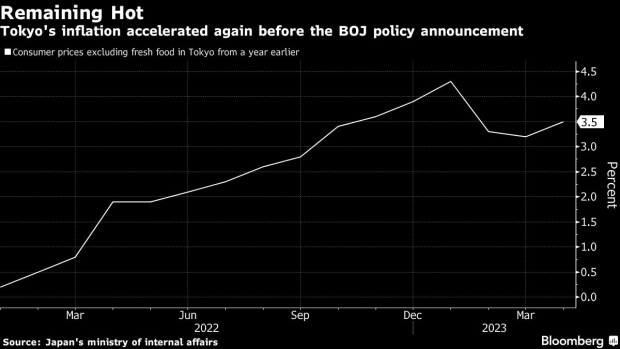

(Bloomberg) -- Inflation in Tokyo unexpectedly gained renewed upward momentum, pointing to a stronger-than-thought underlying price trend as the Bank of Japan prepares to release its latest inflation projections at Kazuo Ueda’s first monetary policy meeting as governor.

Consumer prices excluding fresh food rose 3.5% in the capital in April, picking up speed from 3.2% in the previous month as processed food prices continued to strengthen, according to the ministry of internal affairs Friday. Economists had expected the reading to match its pace in March, after two months of slowing down.

Inflation in Tokyo is a leading indicator of the nationwide trend.

Friday’s result shows that inflation remains hot, even after the government’s stimulus measures curbed utility prices. The key metric has been above the BOJ’s price target of 2% for 11 months in Tokyo, while inflation excluding fresh food and energy has also continued to gain pace, stoking concerns that the bank may be underestimating the strength of underlying price increases.

“April has a lot of service price changes so I was keeping a close watch,” said Mari Iwashita, chief market economist at Daiwa Securities Co. “Looking at the details, service prices for things like hotels and entertainment are rising — inflation is spreading beyond the gains we’ve been seeing in food and eating out.”

Ueda, who is set to conclude his first two-day policy meeting shortly, said in parliament Monday that inflation is expected to cool to below 2% later this fiscal year.

BOJ watchers widely expect the academic-turned-BOJ-chief won’t make a big splash at his first meeting, leaving interest rates and asset purchase settings unchanged. Ueda himself has recently said it’s appropriate to continue with monetary easing including the yield curve control program, given current economic and price conditions.

“The BOJ is unlikely to change its scenario that prices will peak out toward the second half of this fiscal year,” said Iwashita. “I think it’ll continue with easing given the economic outlook as well.”

The BOJ’s price outlook for the upcoming years is a key focus for market watchers. Of particular interest is the central bank’s consumer price index forecast for the fiscal year 2025, which is set to be released for the first time.

While energy prices have been held down by Prime Minister Fumio Kishida’s stimulus package, other daily necessities continue to rise in cost. Prices excluding the impact from energy and fresh food hit 3.8% in April, the highest since 1982.

What Bloomberg Economics Says...

“Inflation above the BOJ’s 2% target has failed to ignite a wage-price spiral. One reason - it’s largely been driven by high costs, not demand. Real pay fell 2.6% year on year in February, as wages failed to keep up with prices.”

— Chang Shu, economist

Click here to read the full report.

Separate data showed labor market conditions continued to weaken in March, with the jobless rate increasing to 2.8% after an unexpected rise in the previous month. The jobs-to-applicant ratio also edged down to 1.32, meaning there were 132 jobs offered for every 100 applicants in a sign that wages may struggle to further strengthen.

Other data showed that Japan’s industrial production gained for the second straight month in March, rising 0.8% from a month earlier. While fears of a global slowdown linger, China’s recovery and the easing of supply chain disruptions have provided a boost to the world’s third-largest economy.

Another report showed retail sales increased 0.6% in March from a month earlier, marking four consecutive months of growth. The resilient spending has been partly driven by recovering inbound demand.

The number of foreign tourists surged to about 1.8 million in March, almost 30 times higher than last year’s figure, amid the cherry blossom season and the resumption of cruise ship operations.

(Updates with more details, economist comments)

©2023 Bloomberg L.P.