Jul 21, 2022

Traders Are Predicting Losses in UK Markets If Liz Truss Wins

, Bloomberg News

(Bloomberg) -- The radical economic policies backed by Foreign Secretary Liz Truss would set UK markets on a downward spiral, according to investors at some of the top asset managers.

Abrdn Investment Director Aaron Rock described her plans to aggressively ramp up government borrowing as the “biggest fear” for the gilts market. Bluebay Asset Management’s Kaspar Hense predicts the pound will drop 2% against the dollar if she’s chosen as the next UK prime minister.

With Truss and Rishi Sunak as the final contenders in the race to lead the nation, investors are trying to grapple with how UK policy will change if either takes power.

Truss has made expansive tax cuts a cornerstone of her platform, which would imply big increases in UK borrowing. Investors also point to her tough stance on European relations and promise to review the Bank of England’s mandate as other worries, though it’s unclear whether she would actually carry out these plans.

Truss Went From Anti-Thatcher Protests to UK Tory Darling

“If Truss was to win the leadership election, then the pound would react very negatively,” said Hense, a portfolio manager at Bluebay. “Populistic policies tend to be bad for the economy over the medium term and weaken the purchasing power of the people.”

Truss’s campaign has also hinted at paying off pandemic-related debt over a longer period as a way to manage the additional debt burden. While the policy details are still vague, it’s a move that could put pressure on longer-dated bonds, according to David Parkinson, sterling rates product manager at RBC Capital Markets.

Meanwhile, Sunak, the former chancellor of the exchequer, would bring more predictable policies. He’s argued that tax cuts must be accompanied by cuts to government spending, and has stood for prudence with the public finances.

“Sunak is the favorite of the market, the most sound, and that should be positive for the pound,” said Hense of Bluebay.

Markets have so far been slow to react to the political turmoil engulfing Downing Street, and all the focus has been on the UK’s weak economy and slow approach to raising interest rates, compared with the US. But the election results could change all of that.

Truss vs. Sunak: Where UK Leadership Contenders Stand on Economy

The pound is already trading at its weakest level against the dollar since 2020, hovering under $1.20. Spreads on pound-denominated corporate bonds have soared this year. Yields on 10-year gilts stand at 2.19%.

“A lot of the moves in the market have been driven by a general reluctance to own sterling credit risk, or frankly anything that has had proximity to the Russia situation,” said Harry Richards, a fund manager at Jupiter Asset Management in London.

There are also concerns that Truss will pressure the central bank into shifting its strategy on interest rates and undermine its independence. In the most recent debate, she questioned the BOE’s handling of inflation. On trade, she’s vowed to override key parts of the Northern Ireland Protocol.

“Truss’s policy platform still poses the greatest risk from an economic perspective in our view with an unseemly combination of pro-cyclical tax cuts and institutional disruption,” Citigroup Inc.’s Chief UK Economist Ben Nabarro wrote in a note.

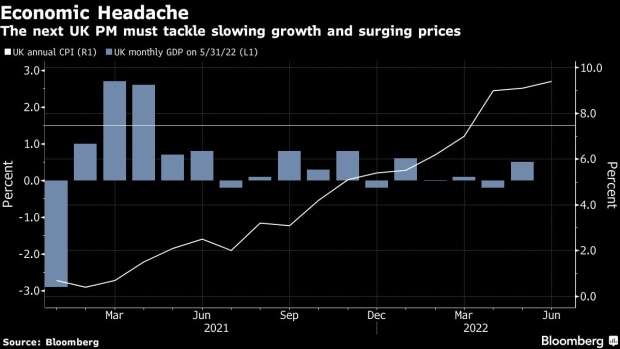

To be sure, there are risks to the UK asset prices no matter who takes power, with inflation at a 40-year high and public-sector workers threatening to go on strike.

Standard Bank strategist Steven Barrow expects sterling to stay weak against the powerful dollar, and slip to $1.15 before the end of the year, regardless of who wins the leadership race.

“The obvious knee-jerk reaction in financial markets is that Sunak would be seen as the preferable winner given his experience as chancellor and his policies going forward, while Truss would be more concerning with respect to her fiscal position,” he said.

©2022 Bloomberg L.P.