Nov 1, 2022

Traders Rush to Buy Scarce UK Debt From BOE While They Still Can

, Bloomberg News

(Bloomberg) -- The dash for scarce UK government debt was on full display Tuesday, according to the breakdown of Bank of England’s inaugural sale of bonds purchased under its quantitative easing program.

Traders placed almost £1 billion of bids on a single bond maturing January 2026, equivalent to 40% of total demand at the auction. They were rushing to get hold of the security before its time to maturity falls below three years, which would make it ineligible from future sales. The BOE reciprocated by selling them more than half of its daily £750 million target.

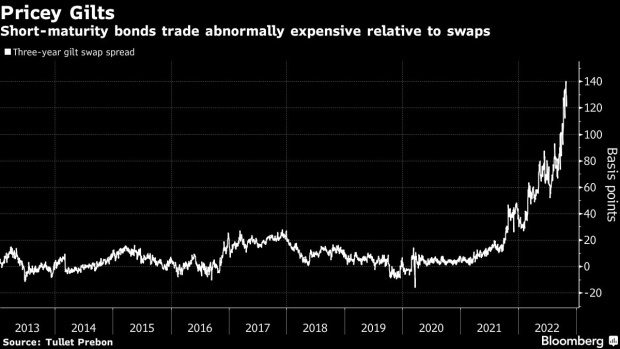

Years of central bank debt purchases have limited the pool of safe government securities freely available to trade, driving up the cost of borrowing bonds in the repo market. Gilt scarcity is particularly acute in the short end of the curve and has hurt liquidity, a distortion that risks limiting the impact of BOE rate hikes.

BOE’s Bond Sales to Improve ‘Urgent Need’ for Gilts, HSBC Says

“The street wants it before it falls under three years in January,” said George Whitehead, a gilt sales specialist at Astor Ridge LLP, noting the BOE owned over 60% of the particular bond.

The dearth of available bonds is pronounced even as the UK faces record net bond supply this fiscal year. Euro-area debt markets face similar headwinds, where a shortage of collateral is keeping short-term rates depressed.

European Central Bank President Christine Lagarde said last week the central bank would be carefully monitoring activity in the market around year-end, when pressure is more common.

©2022 Bloomberg L.P.