May 2, 2023

Traders Zero In on June US Default Risk, Pushing Yields Above 5%

, Bloomberg News

(Bloomberg) -- Yields on Treasury bills for early June soared Tuesday in the wake of a warning from Treasury Secretary Janet Yellen that the US government could run into debt-ceiling limitations as soon as the start of next month.

Even on late Monday, after the announcement by Yellen and a similar one from the non-partisan Congressional Budget Office, the highest rates on Treasury bills were evident around late July and August, signaling greatest concern around that point. But that has since shifted to early June amid the greater liquidity of New York morning trading.

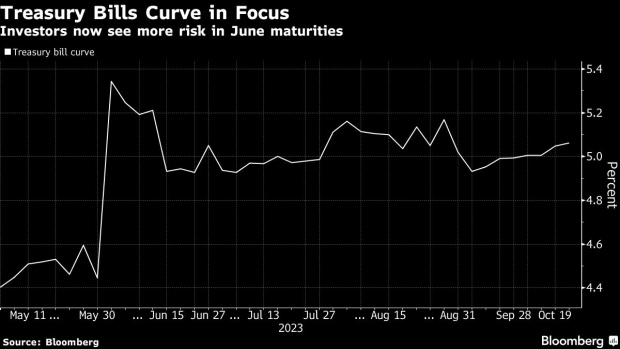

Yields on early June bills are now firmly above 5%, with some above 5.4%. May yields, by contrast are substantially lower, while those for much of July are also below 5%. There is another kink up around early August, reflecting heightened concerns around that period.

“The move in bills is a repositioning for the new X-date with the aid of morning market liquidity,” said TD Securities strategist Gennadiy Goldberg. “The news yesterday came out a bit too late for the market to properly reprice” he said, but “given the early-June warning by both Yellen and the CBO, markets have to take notice.”

The variations between rates on different maturities come about because investors demand a yield premium for any securities that are likely due to be repaid shortly after the US runs out of borrowing capacity. That’s because the government won’t be able to sell fresh securities and get cash to repay holders.

The result, in times of debt-cap stress, is the emergence of kinks in the yield curve. The addition of premiums can appear somewhat haphazard though, in large part because the risks around running out of debt-ceiling headroom are not linear. If the Treasury can make it through until certain key dates where it gets fresh cash injections, for example the mid-June corporate tax date, then it can buy itself some additional breathing room.

T-bill pricing has suggested for some time a level of increased concern stretching from June through much of the US summer, and those rates remain notably elevated compared to securities maturing in the very near term. But within that spectrum of summer-maturity securities, some dates are more concerning than others, and the focus points have sharpened somewhat.

That urgency is being heightened by the narrowing of the window to achieve some kind of political fix — even if only short term. Between now and June 1 — the date by which the Treasury has warned about — President Joe Biden and members of the House and Senate are scheduled to be in town at the same time for just seven days.

Cash Balance

There is, of course, a good chance that there’s more time than that to play with. Figuring that out, though, depends in large part on how the Treasury’s cash balance evolves.

Despite the selloff in bills that’s thrown the focus on early June, Wrightson ICAP economist Lou Crandall still believes the Treasury won’t run out of fiscal resources until July. He did, however, acknowledge that the department’s updated cash flow forecasts are possible and “its concerns about a debt-ceiling accident in June are not unfounded.”

“We suspect that the June X-date outlook will remain fluid at least until after the middle of this month,” Crandall wrote in a note to clients.

The key determinant to how long Treasury can continue to meet its obligations is likely to be how much cash the government has on hand, a measure that’s subject to changes in both receipts and spending.

The amount parked in the Treasury’s General Account has risen to $316 billion as of April 28, but it’s likely to start dwindling again once the flurry of inflows from tax payments dies down. The key for investors is how fast that happens and whether it’s slow enough for the Treasury to limp through to its next substantial cash injection in June.

Yellen’s June 1 timing suggests Treasury isn’t taking any changes given the unpredictability of its cash flows. Barclays Plc estimates the government’s coffers might dip below $50 billion between June 5 and June 15.

“Even this amount is too close for comfort a week or so ahead of mid-June tax date,” strategist Joseph Abate wrote in a note to clients.

Insuring Against Default

Beyond T-bills, one other key market to watch for insight on ceiling risks is what happens in credit default swaps for the US government. Those instruments, which act as a hedge in cases of non-payment, have continued to lurch to new highs. The amount of money tied to the contracts, which will reward investors if the US misses any payments, has increased roughly eight-fold since the start of the year.

(Updates throughout.)

©2023 Bloomberg L.P.