Mar 14, 2024

Treasury Yields Reach Weekly Highs as Inflation Data Disappoint

, Bloomberg News

(Bloomberg) -- US government bond yields climbed to the highest levels in more than a week after a report on wholesale prices eroded confidence in the outlook for Federal Reserve interest-rate cuts this year.

Intermediate- and long-maturity yields rose as much as 10 basis points during the session, the 10-year note’s to 4.29%, the highest level since March 1. Initially, the market’s response to February producer prices was muted by retail sales gauges that were weaker than expected. Rising oil prices helped put the focus back on inflation.

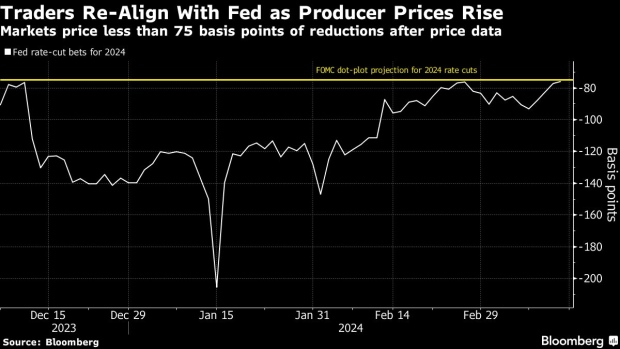

Market-implied expectations for Fed policy faded, with swap contracts that predict interest-rate changes eventually pricing in slightly less than three quarter-point interest rate cuts by year-end. That was the median forecast of Fed policy makers from December, but those projections will be updated next week, and bond investors have grown concerned that sticky inflation readings will result in a less-dovish outlook. The contracts continue to fully price in an initial quarter-point cut in July.

“There’s a battle here between inflation and the consumer, and right now inflation is winning the battle,” Saira Malik, chief investment officer of Nuveen, said in a Bloomberg Television interview Thursday. “The Fed has been pretty clear, they want to see broad disinflation before they start cutting interest rates. We’re not seeing that yet.”

Weekly jobless claims tallies released at the same time as producer prices and retail sales were lower than economists estimated, consistent with strong labor-market conditions forestalling Fed rate cuts. US yields also face upward pressure from growing expectations that the Bank of Japan will scrap its negative-interest-rate policy at next week’s meeting, and from crude oil closing over $80 a barrel for the first time since November.

The selloff saddled buyers of this week’s 10-year and 30-year Treasury auctions with losses. Wednesday’s 30-year sale in particular saw strong demand, with investors taking down the offering at a yield of 4.33%. But after the release of producer prices Thursday, the yield on 30-year bonds rose nearly 10 basis points to 4.44%.

There’s “some re-auctioning of this week’s supply,” said Daniel Mulholland, senior managing director at Crews & Associates. “Yesterday’s 30-year especially was taken at the wrong level.”

Earlier, Treasuries briefly pared their drop after a block trade of 25,000 10-year note futures contracts.

Shorter-maturity yields rose less, as the consensus continues to favor rate cuts this year. Two-year yields, for example, rose only as much as six basis points, lessening the inversion of the Treasury yield curve.

“The data released this morning was very conducive to yield-curve steepening,” said Leah Traub, a portfolio manager at Lord Abbett & Co. “We are potentially in a reflation regime but with the Fed biased towards cutting.”

--With assistance from Kristine Aquino and Michael Mackenzie.

(Adds oil price gain, updates yield levels.)

©2024 Bloomberg L.P.