Aug 17, 2023

Triple-Leveraged Bond ETF Attracts Billions Despite Losing 22% This Year

, Bloomberg News

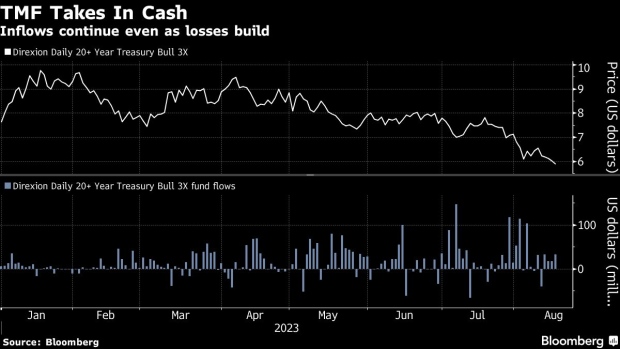

(Bloomberg) -- Not even a double-digit drawdown has slowed the record flood of cash into an exchange-traded fund that offers three times the Treasury market’s performance.

Nearly $2.3 billion has streamed into the the Direxion Daily 20+ Year Treasury Bull 3X (ticker TMF) this year, including more than $500 million in the past month, data compiled by Bloomberg show. Inflows are building even as TMF’s losses intensify, with the ETF sitting on a year-to-date decline of roughly 22% through Wednesday.

TMF, which uses derivatives to deliver three times the performance of long-dated Treasuries, appeals to an audience of short-term day-traders drawn to the product’s volatility, according to VettaFi’s Dave Nadig. Yields on long-dated Treasuries have soared over the past month, powered by stronger-than-expected economic growth, still-high inflation and swelling issuance of the debt. That’s fueled volatility and boosted trading in TMF.

“Nobody is using TMF for long-term exposure,” said Nadig, a financial futurist at the data provider. “Nobody’s buying and holding it for 10 years. They’re day-trading it. More volume means more assets needed.”

TMF has been luring cash since the Federal Reserve embarked on its campaign of interest-rate increases in March last year. The ETF is on track for a 14th straight month of inflows, lifting its total assets to $2.4 billion, from roughly $400 million a year ago.

The appetite has only been building for TMF as losses deepen. The bulk of the ETF’s 2023 plunge has come in the last month as 30-year Treasury yields surged. The more than 20% slump for TMF compares to a 4% year-to-date drop for the $39 billion iShares 20+ Year Treasury Bond ETF (TLT) as of Wednesday’s close.

The performance of TMF was even worse in 2022, when it plunged 73%. But the ETF’s heavy leverage means the pain could escalate quickly from here should long-dated yields continue their ascent. On Thursday, the rate touched 4.42%, the highest since 2011. The 10-year yield reached 4.31%, approaching multi-year highs.

“The 10-year and the 30-year Treasury yield is telling you it’s not necessarily inflation, but growth is a lot stronger than I think most have anticipated,” Mary Ann Bartels, chief investment strategist at Sanctuary Securities, said on Bloomberg Television. “When I look at where we could potentially go on the 10-year, I think we could go to 4.8 to 5%, and I think the 30-year can go to 5%.”

©2023 Bloomberg L.P.