Sep 14, 2020

Triple-leveraged Nasdaq ETF lures record cash amid retail fervor

, Bloomberg News

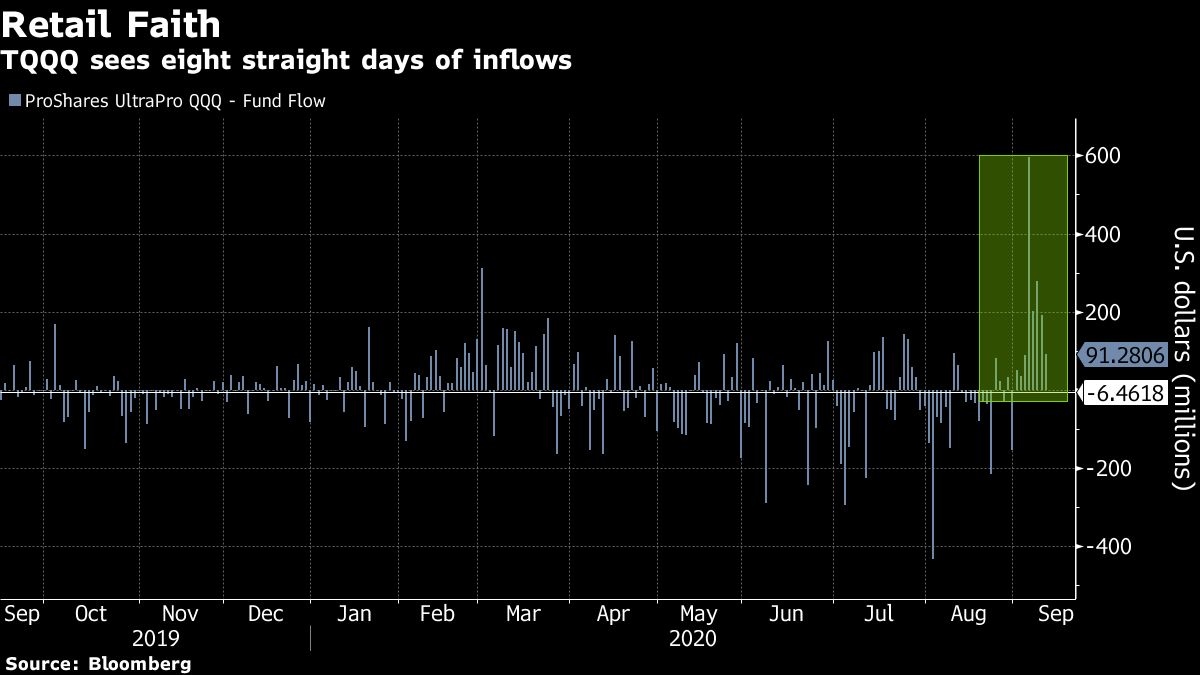

As the crowd of day traders rushed to buy the dip, a triple-leveraged ETF that tracks the Nasdaq 100 notched its best streak of inflows on record.

The US$7.8 billion ProShares UltraPro QQQ (TQQQ) exchange-traded fund attracted more than US$1.5 billion in the past eight days, the most for such a span since it began trading in 2010, according to data compiled by Bloomberg. Meanwhile, its non-leveraged peer Invesco QQQ Trust Series 1 (QQQ) saw US$4.8 billion in outflows last week -- the worst in more than 20 years.

Although the index faced a correction amid concerns over lofty valuations, faith in tech shares won’t be erased so easily among day traders who use leveraged products -- even as investors who are more likely to hold conventional ETFs take profits, according to Todd Rosenbluth at CFRA Research.

“Bullish sentiment toward growth and technology securities remains high, and TQQQ provides an aggressive approach to gaining short-term exposure,” said Rosenbluth, head of ETF and mutual fund research at CFRA

Despite TQQQ’s risks as a leveraged product, it’s become popular with day traders, who pushed volume to a record earlier this month, according to a report from Bloomberg Intelligence. The product is held by 24,000 Robinhood accounts, ranking 20th among ETFs.

“The new variable this year is the number of new, typically younger day traders who use many platforms, but are most visible on Robinhood,” Eric Balchunas, ETF analyst for Bloomberg Intelligence, wrote in the report. “These more aggressive traders prefer single-stock and 3x ETPs to vanilla ETFs or mutual funds, which are less risky.”

Day traders are likely drawn to TQQQ’s eye-popping returns. Before the Nasdaq dropped 5.2 per cent on Sept. 3, the product had returned more than 10,000 per cent since its creation. Even after the correction, its lifetime return is still 8,400 per cent.

Meanwhile, the ProShares UltraPro Short QQQ (SQQQ), which seeks investment results that correspond to three times the inverse of the daily performance of the Nasdaq 100, posted its worst week of outflows since March. That may signal some traders are abandoning bets on tech declining, according to Linda Zhang, chief executive officer of Purview Investments.