Jan 15, 2023

TV Announcer Turned Portfolio Manager Beats 97% of Japan Peers

, Bloomberg News

(Bloomberg) -- Landing a job as an announcer at a major Japanese TV station is a rare feat in itself. Maiko Uda did that in 1997, only to quit in about five years as she found her true calling: finance. Today, she is one of the few female portfolio managers in the world’s third-largest stock market and co-manages a fund that last year beat 97% of its peers.

Betting on macro trends is a key element of Uda’s investment style. One of her expectations is that infrastructure spending in Japan will rise further as the economy recovers from the pandemic, benefiting the commodity operations of trading houses. She also reckons the Bank of Japan will raise its cap for 10-year sovereign yields to 1.5% to 2% within two years from 0.5% now, helping bolster lenders’ interest income.

“We are bullish on Japanese economy overall, and we think that it will do well relative to the US in terms of year-over-year GDP growth,” Uda said in an interview.

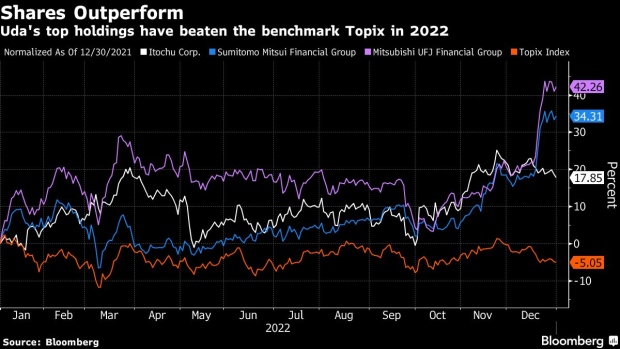

Itochu Corp. is the top holding in the fund that she runs with her father, who founded Tokyo-based Evarich Asset Management in 2002. The fund also has large bets on Marubeni Corp. and Mitsubishi Corp., a bullishness toward trading houses that’s shared by Warren Buffett’s Berkshire Hathaway Inc.

Sumitomo Mitsui Financial Group Inc. and Mitsubishi UFJ Financial Group Inc. are the second- and third-largest holdings.

E.I. Sturdza Fund plc - Nippon Growth (UCITS) Fund, the 6.6 billion yen ($52 million) equity fund that Uda runs with her father Yutaka Uda, returned almost 16% in 2022 as Japan’s benchmark Topix index dropped 5.1%. The two were jointly ranked No. 5 Japanese equities fund managers according to Citywire rankings for the year to Nov. 30, 2022.

The BOJ will probably move further away from keeping bond yields low after Governor Haruhiko Kuroda’s term ends in April, Uda said, adding that the central bank’s December shift in its yield-curve control program was the first sign of that.

READ: BOJ Watchers See Earlier Policy Shift After December’s Surprise

Stanford, Fidelity

Getting to where she is now took time and involved a significant career change.

Her first job after graduating from college was that of an announcer at Fuji Television Network Inc., a tough field to get into. In some years, only about 1% of applicants get employed as announcers, according to Saeki Announce School, a Tokyo-based career training institution.

But she found the constant public exposure as an announcer to be stressful and assignments seemed to be given at times based more on popularity rather than experience and expertise, so she left Fuji TV in 2001 to study at the Stanford Graduate School of Business. She then joined Fidelity Investments as an analyst in 2005, focusing on the real estate and auto sectors and getting experience in equity research before deciding to work with her father at Evarich Asset in 2009.

Globally, only 14% of fund managers are females, according to a 2021 report by Morningstar Inc., while in Japan, less than 10% of executives at large asset management firms on average were women, a survey last year by the Financial Services Agency showed.

“I definitely felt that this is a male-oriented industry, and in many meetings I was the only female,” Uda said. But she appreciates the fact that the bottom line is the fund’s performance regardless of whether the manager is a woman or a man.

Other Bets

In addition to trading houses and banks, Uda’s fund is overweight on construction machinery makers and marine transportation firms that she expects will get a lift from investments in infrastructure and China’s reopening.

Japanese firms are already spending more to improve their fixed assets, with smaller manufacturers planning to boost capital expenditures by 20% in the fiscal year ending March 31, according to a Japan Finance Corp. survey. The government has also earmarked about 7 trillion yen to help increase investments over the next few years, a Ministry of Economy, Trade and Industry document shows.

Meantime, while many analysts see semiconductor prices bottoming soon, Uda is bearish on the industry, saying that prices will go down even more as government subsidies to the sector cause oversupply in the market.

The strong showing of her fund has boosted her confidence working in a small firm in one of biggest financial markets in the world.

“Working at Fuji TV, then Stanford and Fidelity, I always felt that I needed the big names just to feel more secure,” Uda said. “When I left Fidelity around the age of 35, I was more comfortable of my capability and started to think that I don’t need the big names anymore.”

--With assistance from Hideyuki Sano.

(Adds more details on career moves.)

©2023 Bloomberg L.P.