Oct 10, 2019

U.S., China start talks aiming for mini deal to ease tariff pain

, Bloomberg News

U.S.-China tensions could last for a while: Trump's former chief trade negotiator

The U.S. and China began two days of talks aimed at easing hostilities in their 18-month trade war, with both sides signaling cautious optimism in securing a partial deal that could lead to a temporary truce on tariffs.

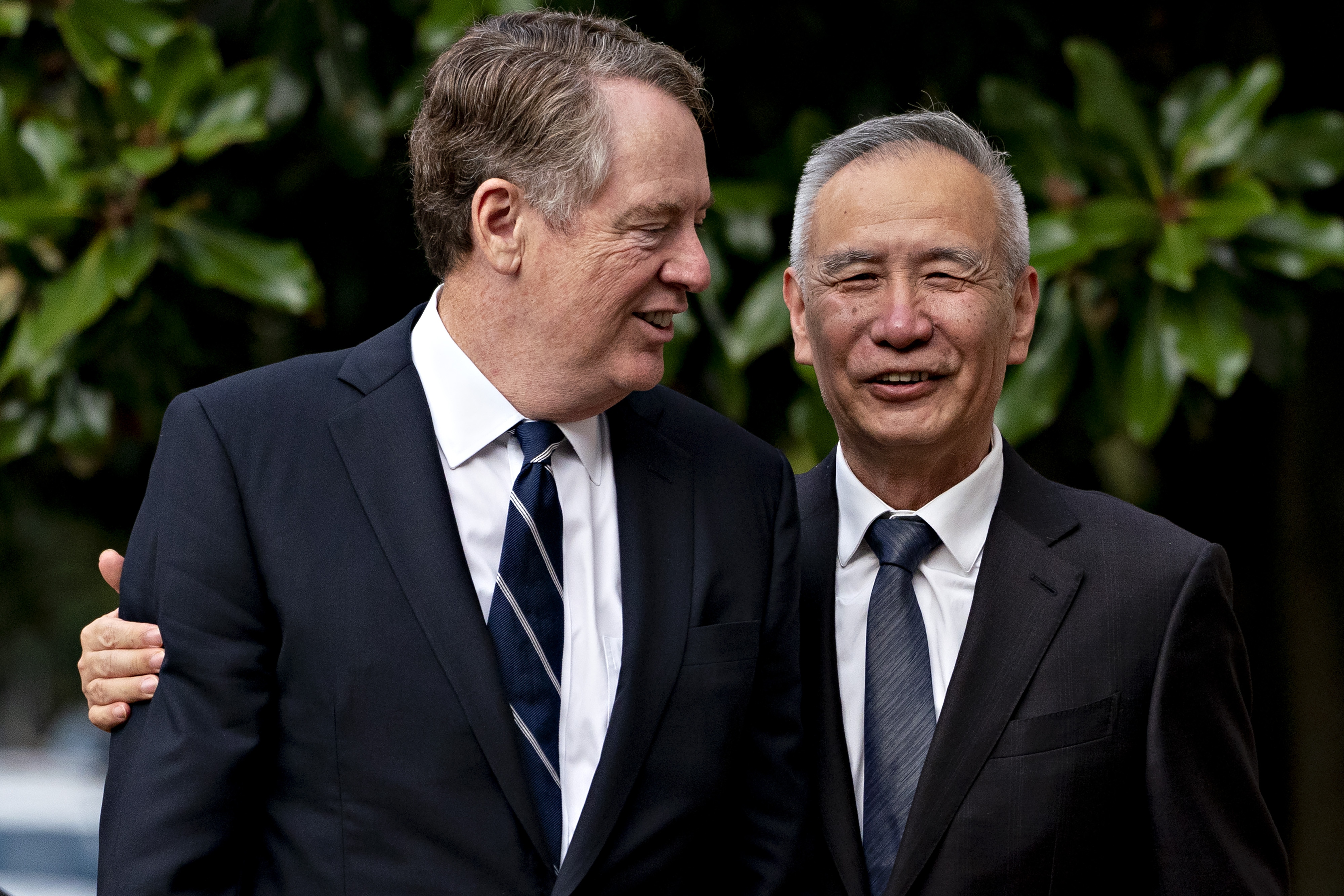

Vice Premier Liu He and the rest of the high-level Chinese team arrived at the office of U.S. Trade Representative Robert Lighthizer at around 9 a.m. in Washington.

Here’s a rundown of developments:

- President Donald Trump said in a Twitter post that he plans to meet with Liu on Friday, adding that it’s a “big day of negotiations with China. They want to make a deal, but do I?”

- The White House is looking at rolling out a previously agreed currency pact with China as part of an preliminary deal that could also see a planned tariff increase next week suspended, people familiar with the discussions told Bloomberg.

- Separately, Bloomberg is reporting that China plans to ask the U.S. to lift sanctions on its biggest shipping company, citing people familiar with the matter.

- A Chinese official said Wednesday the country was still open to reaching a partial trade deal with the U.S. that may include large purchases of American commodities, but added that success was contingent on Trump halting further tariffs.

- Trump last week approved licenses for some American companies to sell nonsensitive goods to Huawei Technologies Co., the New York Times reported, citing people familiar with the move. While Trump committed to the move after meeting President Xi Jinping in June, no licenses have been issued yet.

- U.S. stocks were up 0.7 per cent at 10 a.m. in New York, the Bloomberg Dollar Spot Index was down 0.2 per cent and the yield on 10-year Treasuries rose for a second day.

The currency accord, which the U.S. said had been agreed to earlier this year before trade talks broke down, would be part of what the White House considers to be a first-phase agreement with Beijing. It would be followed by more negotiations on core issues like intellectual property and forced technology transfers, the people said.

The internal deliberations come as the countries hold the first face-to-face talks between senior officials since July.

People familiar with the Chinese delegation’s arrangements said negotiators are currently scheduled to leave on Friday evening, though there could be changes depending on how the talks progress.

What Our Economists Say:

“An agreement on exchange rates could be a practical, face-saving way for both sides to reach a mini-deal that helps de-escalate trade tensions. In practice, though, it would probably have limited implications on China’s exchange rate policy -- barring an (unlikely) Plaza Accord type of commitment.”

--Chang Shu and David Qu

The discussions around an interim deal come as the Trump administration this week further ramped up pressure on Beijing by blacklisting Chinese technology firms over their alleged role in oppression in the far west region of Xinjiang, as well as placed visa bans on officials linked to the mass detention of Muslims. At the same time, a fight over free speech between China and the NBA, triggered by a tweet backing Hong Kong’s protesters, has underscored the heated tensions.

The window for such an agreement is closing before the U.S. plans to raise duties to 30 per cent from 25 per cent on about US$250 billion of Chinese imports on Oct. 15. Additional duties are set to take effect Dec. 15.

Showing progress with a currency pact and other matters could serve as a reason to delay next week’s tariff hike. Bloomberg News last month reported the White House was discussing plans for an interim deal.

Still, Trump on Monday said he preferred a complete trade agreement with China. “My inclination is to get a big deal. We’ve come this far. But I think that we’ll just have to see what happens. I would much prefer a big deal. And I think that’s what we’re shooting for,” he said.

A White House spokesman declined to comment. A Treasury spokesman didn’t respond to a request for comment. China’s Ministry of Commerce did not immediately respond to fax about the high-level talks.

Manipulation Label

No details were made public about the U.S.-China currency pact reached in February that Mnuchin at the time called the “strongest” ever. Broader trade negotiations between the two countries broke down in May after the U.S. accused China of backtracking on its commitments. Then, in August, the Trump administration formally declared China a currency manipulator.

According to people familiar with the currency language, the pact largely resembles what the U.S. agreed to in a new trade agreement with Mexico and Canada and also incorporates transparency commitments included in Group of 20 statements.

Still, Lighthizer cautioned earlier this year that the currency agreement hinges on the overall enforcement of the trade deal. “There’s no agreement on anything until there’s agreement on everything. But the reality is we have spent a lot of time on currency, and it’ll be enforceable,” he said in congressional testimony on Feb. 27.

The U.S. Treasury, which is in charge of monitoring potential currency manipulators, is expected to publish its next report on the foreign-exchange policies of major trading partners around mid-October.

Liu met with a small group of business executives and separately with International Monetary Fund officials Wednesday afternoon, people familiar with the meetings said.

--With assistance from Saleha Mohsin, Livia Yap, Angus Whitley, Miao Han, Steven Yang and William Edwards.