Jun 10, 2020

U.S. consumer prices declined for a third month in May

, Bloomberg News

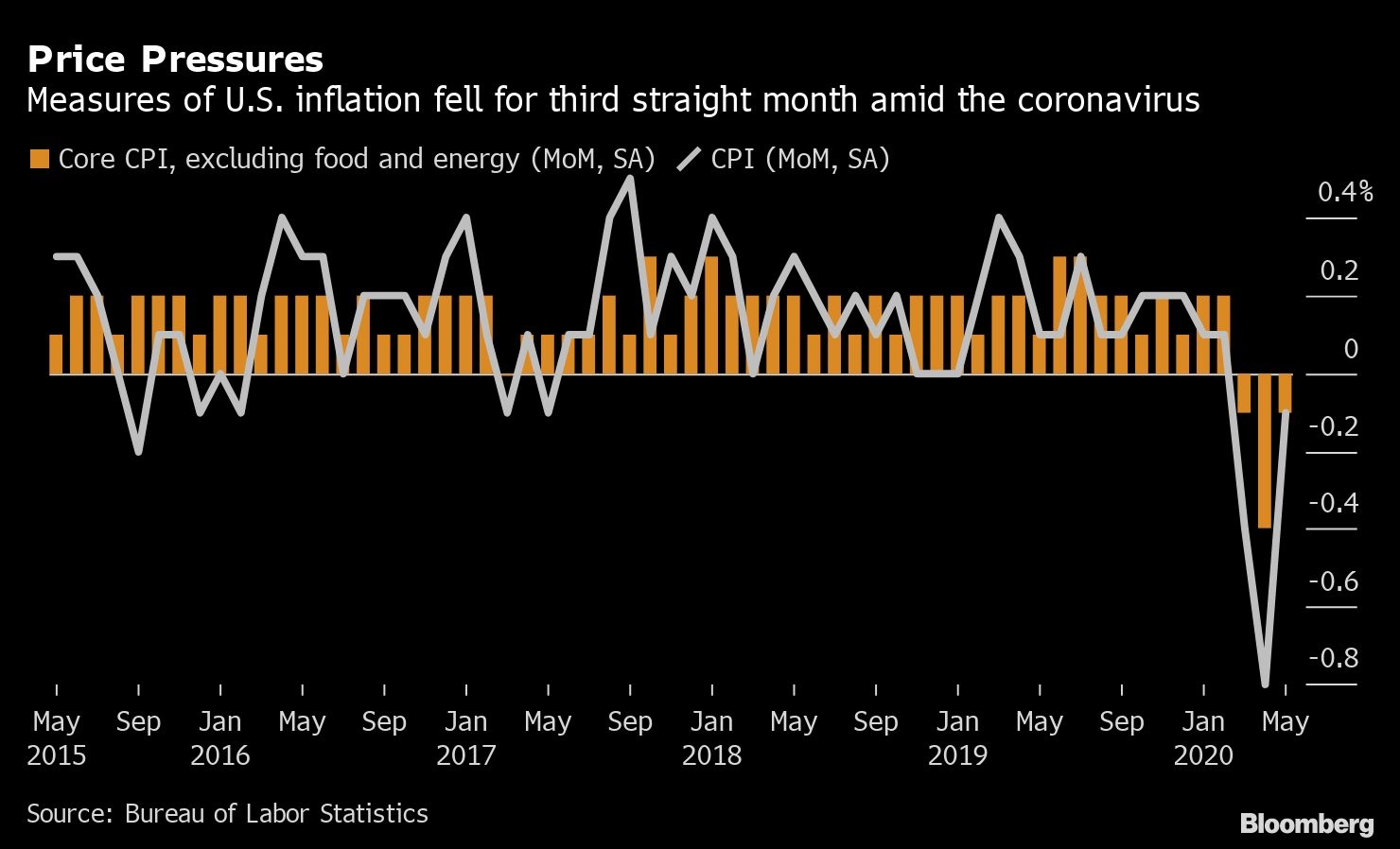

U.S. consumer prices declined in May for a third straight month as the coronavirus-induced recession continued to depress demand.

The consumer price index fell 0.1 per cent from the prior month after a 0.8 per cent drop in April that was the biggest since 2008, Labor Department figures showed Wednesday. The gauge increased 0.1 per cent from a year earlier following a 0.3 per cent gain in the year through April.

The core CPI, which excludes volatile food and fuel costs, also fell 0.1 per cent from the prior month after a 0.4 per cent decrease in April. Consumer inflation by that measure rose 1.2 per cent from the prior year, the smallest advance since 2011, following 1.4 per cent in April.

The third month of falling prices could spur concern about the risk of deflation as the U.S. economy begins recovering from the COVID-19 recession. At the same time, with states relaxing restrictions and stay-at-home orders, prices stand to increase with the pickup in demand for goods and services.

The Federal Reserve -- which targets two per cent inflation based on a separate Commerce Department measure -- often looks to the core index for a better gauge of underlying price trends, and those costs have also declined three consecutive months. Policy makers are set to announce projections later Wednesday showing how long they expect to keep interest rates near zero.

Complicating the inflation figures is the fact that Americans have drastically curtailed purchases of some key elements of the index, such as air travel and clothing, while auto-insurance companies slashed premiums on account of fewer car trips. That’s made the CPI less representative of the prices consumers are experiencing on a day-to-day basis during the pandemic. Weightings of various items were largely little changed in the latest report.

Grocery Bills

After surging in April by the most since 1974, the cost of groceries rose one per cent from the prior month, as Americans continued to eat more meals at home amid the pandemic.

Prices for clothing, gasoline, car insurance, and airfares showed another month of declines, despite some states reopening activity. Apparel prices dropped another 2.3 per cent, motor vehicle insurance costs plummeted a record 8.9 per cent and airfares were down 4.9 per cent.

The cost of services, which make up the majority of the CPI, were unchanged after a 0.4 per cent drop the prior month.

The Bureau of Labor Statistics flagged issues with collecting data for another month, with in-person collection suspended and some establishments temporarily closed.

A separate Labor Department report showed inflation-adjusted average hourly earnings rose 6.5 per cent in May from the prior year.