Mar 1, 2022

U.S. Expects Chinese Tech Firms to Help Choke Off Russia Supply

, Bloomberg News

(Bloomberg) -- Washington is expected to lean on major Chinese companies from Semiconductor Manufacturing International Corp. to Lenovo Group Ltd. to join U.S.-led sanctions against Russia, aiming to cripple the country’s ability to buy key technologies and components.

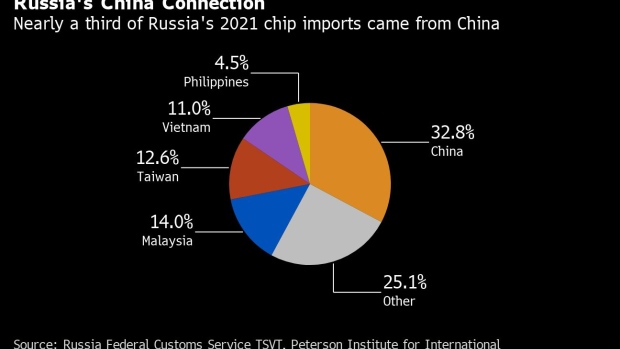

China is Russia’s biggest supplier of electronics, accounting for a third of its semiconductor imports and more than half of its computers and smartphones. Beijing has opposed the increasingly severe measures that the U.S. has taken to restrict Russia’s trade and economy in response to its invasion of Ukraine, however U.S. officials expect tech suppliers such as SMIC to uphold the new rules and curtail trade of sensitive technology with American origin, especially as it relates to Russia’s defense sector.

Any items produced with certain U.S. inputs, including American software and designs, are subject to the ban, even if they are made overseas, a U.S. official told Bloomberg News on Monday. Companies that attempt to evade these new controls would face the prospect of themselves being cut off from U.S.-origin technology and corporate executives risk going to jail for violations.

Consumer electronics such as Apple Inc. iPhones and laptops for personal use are not affected.

Foreign companies have taken rapid steps to pull out of Russia in the wake of its military aggression, reversing three decades of investment by Western and other overseas businesses following the collapse of the Soviet Union in 1991. Oil firms BP Plc, Shell Plc and Equinor ASA each announced plans to withdraw from partnerships and projects in Russia and the U.S. government has promised incentives for “countries that adopt substantially similar export restrictions” in a push for multilateral cooperation.

Foreign Companies From Shell to Daimler Are Abandoning Russia

Russia gets 70% of its supply of chips, computers and smartphones from China, according to Mary Lovely of the Peterson Institute for International Economics, citing 2020 data from the United Nations International Trade Statistics Database. On Monday, China’s Foreign Ministry again voiced its disapproval of sanctions.

“China doesn’t approve of resorting to sanctions to try to resolve problems, even more we oppose illegal, unilateral sanctions without an international mandate,“ Foreign Ministry spokesman Wang Wenbin said at a regular press briefing in Beijing. He added that nations “should not harm the legitimate rights and interests of the Chinese side.”

Beijing has made self-sufficiency in the semiconductor sector a national priority, but for now its tech companies still rely heavily on U.S. designs and technology. SMIC continues to use chipmaking equipment from American vendors including Applied Materials Inc. even after it got blacklisted by the U.S. in 2020. If the company fails to comply with U.S. sanctions, it could face tightening of restrictions that may make it more difficult or impossible to secure licenses for repair parts and new equipment.

Meanwhile, smartphone maker Xiaomi Corp., like the majority of mobile electronics vendors, uses chips from Qualcomm Inc., Qorvo Inc., and Skyworks Solutions Inc., according to Bloomberg’s supply chain data analysis. And Lenovo depends on Advanced Micro Devices Inc. and Intel Corp.’s processors for its PC products.

Representatives of SMIC, Lenovo and Xiaomi didn’t immediately respond to requests for comment.

The U.S. tech sanctions against Russia mirrored Washington’s move in 2020 to cut off Chinese telecom giant Huawei Technologies Co.’s access to critical chips the company needed for its smartphone and 5G operations amid prolonged international trade tensions. Huawei has seen its core business units falter and its sales plummet since.

©2022 Bloomberg L.P.