Jun 1, 2018

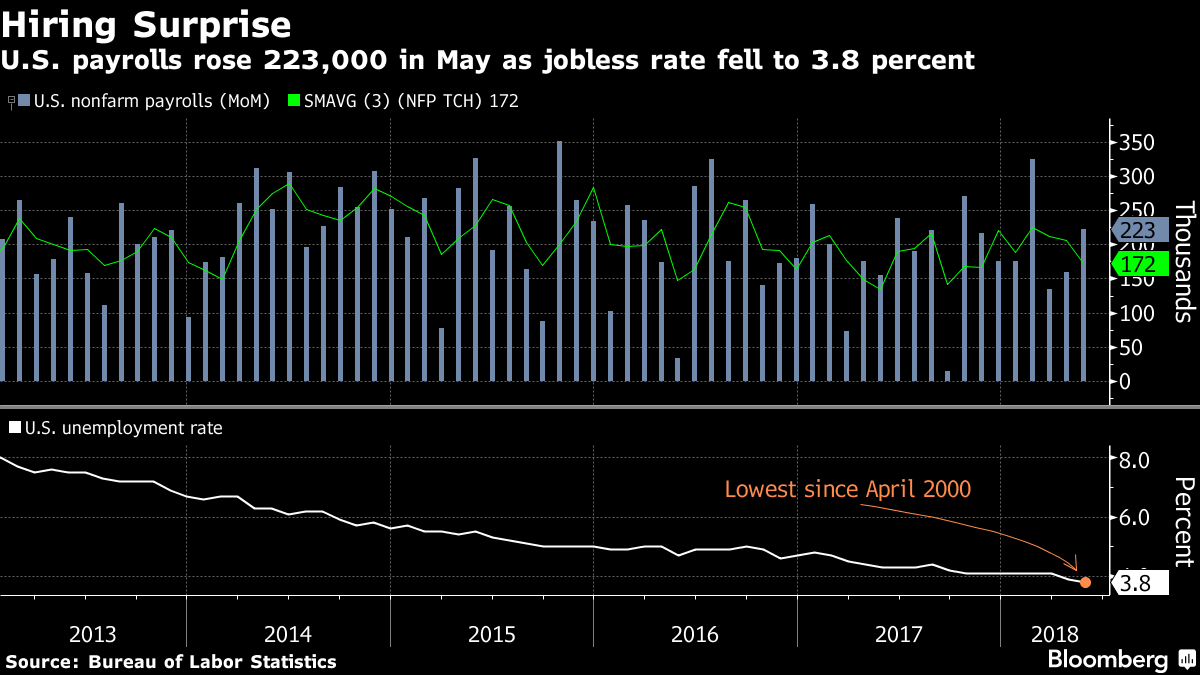

U.S. payrolls rise 223,000 as jobless rate matches historic low

, Bloomberg News

U.S. hiring rose more than forecast in May, wages picked up and the unemployment rate matched the lowest in almost five decades, indicating the strong labor market will keep powering economic growth.

Payrolls increased 223,000 following a revised 159,000 gain, Labor Department figures showed Friday. The median estimate of analysts surveyed by Bloomberg called for 190,000 jobs. Average hourly earnings increased 2.7 per cent from a year earlier, more than projected, while the jobless rate fell to 3.8 per cent from 3.9 per cent to match April 2000 as the lowest since 1969.

The report reinforces expectations for Fed policy makers to raise interest rates when they meet June 12-13, and may spur bets on two more hikes this year after that, rather than one. Steady hiring and lower taxes will bolster consumer spending, helping to support the projected rebound in U.S. growth this quarter and continuing to trim the unemployment rate. Wage gains, while positive in the latest report, have yet to show a sustained acceleration.

“The job market is red hot,” Ryan Sweet, an economist at Moody’s Analytics Inc. in West Chester, Pennsylvania, said before the report. Still, “it’s only going to get harder to find workers. We’ll see trend job growth begin to cool.”

President Donald Trump tweeted an hour before Friday’s release that he was “looking forward to seeing” the figures, spurring market speculation that the report would be upbeat, and it was. In addition to payrolls topping economists’ forecasts, the unemployment rate had been projected to remain at 3.9 per cent, while wage gains exceeded estimates for 2.6 per cent.

UPWARD PRESSURE

The jobless rate fell further below Fed estimates of levels sustainable in the long run, a potential source of upward pressure on wages and inflation, according to some economists. The fiscal boost from the Republican-backed tax cuts may also boost inflation at a time when the economy is near full employment, while a protracted trade war, sparked by Trump administration tariffs, would pose a growth risk.

Revisions to prior reports added a total of 15,000 jobs to payrolls in the previous two months, according to the figures, resulting in a three-month average of 179,000.

Economists estimate that monthly payroll gains of less than 100,000 are sufficient to keep pushing down the unemployment rate, which is derived from a separate Labor Department survey of households and is near levels considered consistent with at or below full employment.

The payroll gains in May were fairly broad-based, with construction adding 25,000 jobs and manufacturing adding 18,000. Service providers boosted employment by 171,000, led by increases in retail; education and health services; leisure and hospitality; and transportation and warehousing. Auto and parts makers and temporary help services recorded declines.

The number of employed people in the workforce rose by 293,000, the report showed, while the number of unemployed decreased by 281,000, helping push down the jobless rate.

LABOUR HEALTH

The participation rate, or share of working-age people in the labor force, decreased to 62.7 per cent from 62.8 per cent the prior month. The employment-population ratio, another broad measure of labor-market health, rose to 60.4 per cent from 60.3 per cent. Fed Governor Lael Brainard noted in a speech Thursday that the employment-to-population ratio for prime-age workers remains about 1 percentage point below its pre-crisis level.

The participation rate remains a closely-watched measure for central bankers. While improving prospects for employment and wages are helping attract people who were on the sidelines of the job market, the retirements of older workers have been exerting downward pressure on participation.

The tight job market is helping lift worker pay. Average hourly earnings rose 0.3 per cent from the prior month, topping projections for 0.2 per cent, following a 0.1 per cent gain, the report showed. The 2.7 per cent gain for the 12 months ended in May followed a 2.6 per cent advance.

A separate measure, average hourly earnings for production and non-supervisory workers, was even more upbeat, increasing 2.8 per cent from a year earlier, the most since mid-2009. That followed a 2.6 per cent gain in April.

Other Details

- The U-6 underemployment rate fell to 7.6 per cent from 7.8 per cent; the gauge includes part-time workers who’d prefer a full-time position and people who want a job but aren’t actively looking

- People working part-time for economic reasons fell by 37,000 to 4.95 million

- Private employment rose by 218,000 (est. 190,000) after increasing 162,000; government payrolls rose by 5,000

- The average work week for all private employees was unchanged at 34.5 hours

--With assistance from Chris Middleton and Sophie Caronello.