Feb 24, 2023

U.S. stock traders hit sell button in 2023’s worst week

, Bloomberg News

BNN Bloomberg's closing bell update: Feb. 24, 2023

Wall Street’s reaction to hotter-than-estimated inflation data suggested growing bets the Federal Reserve has a long ways to go in its aggressive tightening crusade, making the odds of a soft landing look slimmer.

After a lengthy period of subdued equity swings, volatility has been gaining ground. Aside from all the economic uncertainties, that’s reflective of a market that’s gotten more expensive after an exuberant rally from its October lows. Those gains have been dwindling by the day amid fears that a potential recession could further hamper the outlook for Corporate America.

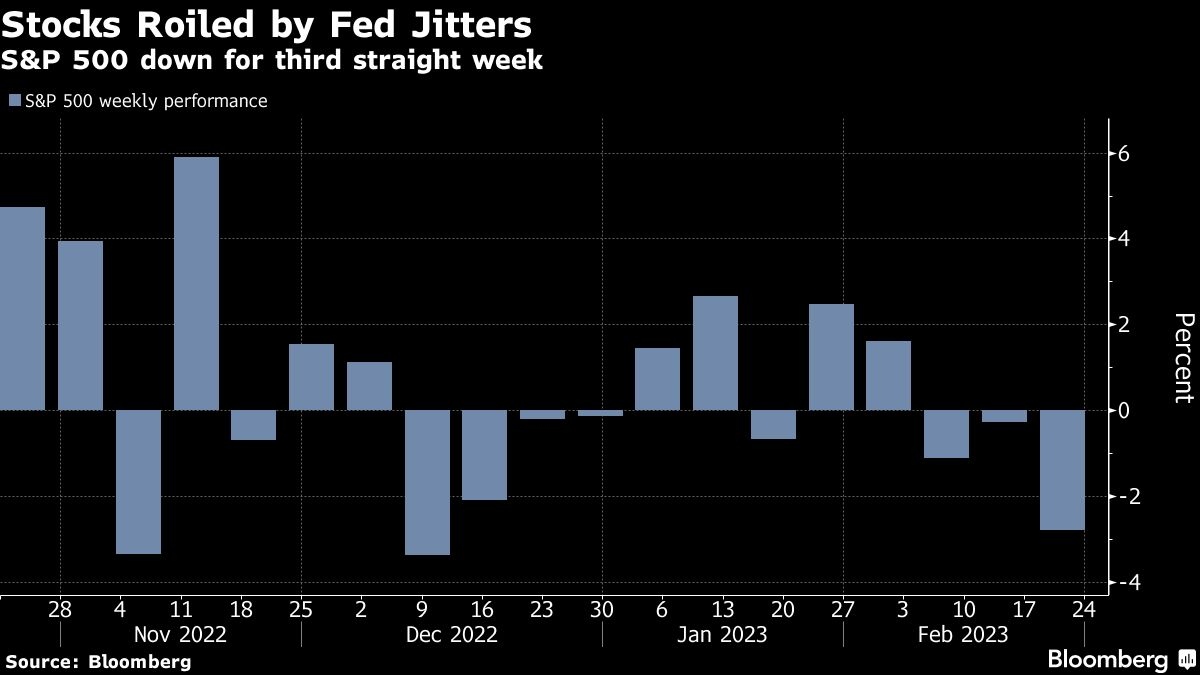

A slide in the S&P 500 Friday deepened its weekly rout — the worst in 2023. The tech-heavy Nasdaq 100 sank almost 2 per cent as the Treasury two-year yield hit 4.8 per cent, the highest since 2007. The dollar climbed. Swaps are now pricing in 25 basis-point hikes at the Fed’s next three meetings, and bets on the peak rate rose to about 5.4 per cent by July. The benchmark sits in a 4.5 per cent-4.75 per cent range.

“There’s little room for upside in stocks right now given the inflation news, current market valuations after the January rally, and a weak Q4 earnings season,” said Brian Overby, senior markets strategist at Ally. “The ‘no landing’ view is quickly becoming more of a ‘bumpy landing’ view with the concept of higher interest rates for longer settling in.”

The unexpected acceleration in the personal consumption expenditures gauge underscored the risks of persistently high inflation. Furthermore, resilient spending paired with the exceptional strength of the labor market could make it tougher for the Fed to get inflation to its 2 per cent goal. Separate data showed U.S. consumer sentiment rose to the highest in a year while new home sales topped forecasts.

'Do a Little More'

Cleveland Fed President Loretta Mester noted the latest inflation report is consistent with the fact policymakers need to “do a little more” to ensure inflation is moving back down. Her Boston counterpart Susan Collins said the central bank has to keep raising rates to get them to a sufficiently restrictive level and it may need to hold them there for an “extended” period.

“Move quickly now, reestablish credibility now,” said St. Louis Fed President James Bullard.

Officials may need to raise rates as high as 6.5 per cent to defeat inflation, according to new research that was critical of the central bank’s initially slow response to rising prices. In a paper, a quintet of economists and academics argue that policymakers have an overly-optimistic outlook and will need to inflict some economic pain to get prices under control.

Mohamed El-Erian says financial markets are starting to doubt whether the Fed can bring inflation down to its target.

“We’re seeing actual and survey indicators heading the wrong way,” El-Erian, the chairman of Gramercy Funds and a Bloomberg Opinion columnist told Bloomberg Television.

More Comments:

- David Donabedian at CIBC Private Wealth U.S.:

- “So the bullish narrative that the market had coming into the year of slowing economy headed toward a soft landing and slowing inflation allowing the Fed to stop raising rates ASAP, that’s been blown up here by the data. My view is that the market rally that we’ve seen since October was a bear-market rally.”

- Peter van Dooijeweert at Man Solutions:

- “Today’s PCE data is a little bit more than the market wants to deal with. It’s fine to have rising rates off good economic data and avoiding a hard landing. It’s just not OK for the market to have to grapple with a return to rising inflation.”

- Krishna Guha at Evercore:

- “The likelihood of achieving a soft landing dips, with the risk of no-landing potentially forcing the Fed to push rates higher and hold longer, with greater risk that this ultimately pushes the economy into a mild recession. So risk-off pure and simple.”

- Greg Wilensky at Janus Henderson:

- “This was not the news the Fed or investors had been hoping for and, as such, we expect markets to adjust to the likelihood that the Fed will need to raise rates higher, and keep them higher for longer, than they had been pricing in previously.”

- Chris Zaccarelli at Independent Advisor Alliance:

- “It is much too soon for the Fed to say ‘mission accomplished.’ It is far too early to extend duration and buy the dips in bond prices, let alone trying to continue to buy the dips in the stock market. We have been exercising much more caution and have advised our clients to be careful and not aggressive at this point in the economic cycle.”

- Peter Boockvar, author of the Boock Report:

- “Bottom line, Treasury yields are moving higher in response to the higher than expected inflation stats and reminder that while the trend will still be down, it will still take time to get to some Fed comfort level. Either way, at least looking at the core PCE, we FINALLY have ZERO real interest rates. I know some are still trying to figure out how many hikes the Fed has left, but it’s not many and AGAIN, higher rates for a longer time frame should be the focus.”

- Jeffrey Roach at LPL Financial:

- “The Fed may still decide to hike by 0.25 per cent at the next meeting, but this report means that the Fed will likely continue hiking into the summer. Markets will likely stay choppy during these months where higher rates have yet to materially cool consumer spending.”

As investors position for the risk that the Fed persists with hawkish policy moves, they have been dumping equities and cash alike in favor of bonds, Bank of America Corp. strategists said.

Global equity funds lost US$7 billion in outflows in the week through Feb. 22, while US$3.8 billion left cash funds, according to a note from the bank, which cited EPFR Global data. At US$4.9 billion, bonds drew additions for an eighth straight week in the longest such streak since November 2021, the team led by Michael Hartnett said.

Money managers are fortifying portfolios and hedging the risk of a prolonged inflation fight by sticking to credit maturing in just a few years.

Some funds are actively cutting so-called duration, a measure of sensitivity to interest rates, to limit the fallout if central banks keep hiking to tackle inflation. Others are simply focusing on short-dated notes as the additional yield they get from longer securities is too small to justify the risk of a slump when rates rise.

Faced with declining earnings and heavy debt loads, companies are reducing payouts to shareholders to improve the health of their balance sheets.

So far this year, as many as 17 companies in the Dow Jones U.S. Total Stock Market Index cut their dividends, according to data compiled by Bloomberg. Still, it isn’t a decision that executives make easily, as it can scare off investors and dent share prices.

In corporate news, Boeing Co. sank after pausing deliveries of its 787 Dreamliner over a documentation issue with a fuselage component. Carvana Co. slumped on a much wider loss than Wall Street had expected for the used-car retailer. Beyond Meat Inc. surged on sales that exceeded expectations and the plant-based meat maker showed progress toward its goal of becoming profitable.

On the geopolitical front, the U.S. will impose a 200 per cent tariff on all imports of Russian-made aluminum, as well as aluminum products made with metal smelted or cast in the country, in a move that could ripple through global manufacturing supply chains.

Treasury Secretary Janet Yellen warned China and other nations against providing material support to Russia, saying any such actions would amount to an evasion of sanctions and would “provoke very serious consequences.”

Elsewhere, the yen retreated as Bank of Japan Governor nominee Kazuo Ueda warned against any magical solution to produce stable inflation and normalize policy as he largely stuck to the existing central bank script in the first parliamentary hearing to approve his appointment.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.1 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 1.7 per cent

- The Dow Jones Industrial Average fell 1 per cent

- The MSCI World index fell 1.2 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.7 per cent

- The euro fell 0.5 per cent to US$1.0547

- The British pound fell 0.6 per cent to US$1.1943

- The Japanese yen fell 1.3 per cent to 136.40 per dollar

Cryptocurrencies

- Bitcoin fell 2.8 per cent to US$23,207.5

- Ether fell 2.1 per cent to US$1,610.62

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 3.95 per cent

- Germany’s 10-year yield advanced six basis points to 2.54 per cent

- Britain’s 10-year yield advanced seven basis points to 3.66 per cent

Commodities

- West Texas Intermediate crude rose 1.6 per cent to US$76.59 a barrel

- Gold futures fell 0.5 per cent to US$1,818.10 an ounce