Jan 20, 2023

U.S. stocks bounce thanks to tech rally, Fed comments

, Bloomberg News

BNN Bloomberg's closing bell update: Jan. 20, 2023

U.S. stocks clawed back some of this week’s losses as a tech rally buoyed risk sentiment and comments by Federal Reserve officials dialed back fears of overly aggressive policy moves.

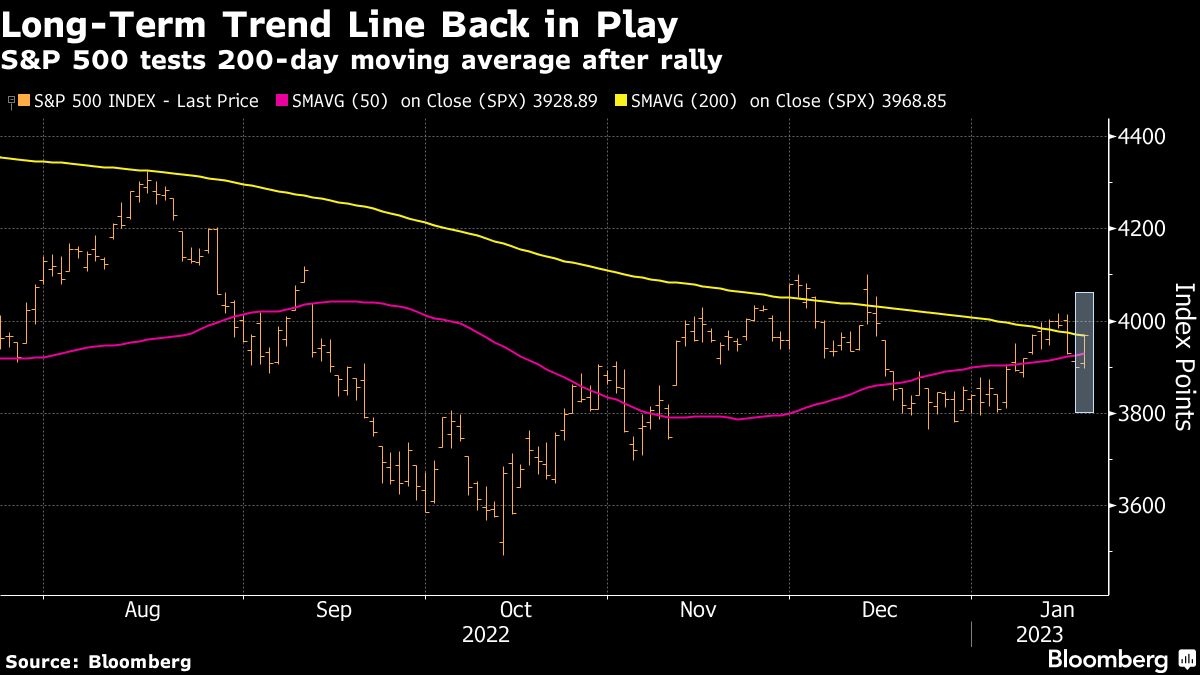

The S&P 500 Index rose for the first time in four days, with all 11 sectors gaining. While the broad benchmark remained down on the week, the bounce back in the tech-heavy Nasdaq 100 pushed it into the green for the period. Google parent Alphabet Inc. gained after revealing a plan to cut 12,000 jobs. Netflix Inc. surged after reporting stronger-than-expected subscriber numbers.

Benchmarks climbed to session highs on Friday after Fed Governor Christopher Waller said policy looks pretty close to sufficiently restrictive and he backed moderation in the size of rate increases. Earlier, Philadelphia Fed President Patrick Harker repeated his view for more incremental steps in rate hikes, while Kansas City Fed chief Esther George said the economy can avoid a sharp downturn.

Equity markets rallied despite a push higher in Treasury yields, suggesting that the 60/40 portfolio model could be making a comeback. Earlier this week, higher rates and hawkish comments from Fed and European Central Bank officials weighed on risk sentiment.

“It’s notable that yields are up today yet Nasdaq is outperforming,” said Jonathan Krinsky, chief market technician for BTIG. “While this could be perceived as a short-term positive, if we are shifting to a ‘bad news is bad’ narrative where lower rates coincide with lower stocks, then it would make sense to see the inverse.”

Earnings have also been in focus. Of the 55 S&P 500 companies that have reported results so far, about two-thirds have beaten analysts’ estimates, compared with the 80 per cent positive surprise seen over the past several quarters.

“Fears of a recession seemed to be overriding a sort of optimism from some companies which have reported better-than-expected results,” said Fiona Cincotta, senior financial markets analyst at City Index. “There is this understanding that earnings are probably going to be weaker, but I think a lot of that’s being priced in.”

Oil rallied to the highest since mid-November, capping off its second straight week of gains on optimism over increased demand from China. West Texas Intermediate rose to settle above US$81 a barrel, posting a 1.8 per cent weekly gain.

Here are some of the main market moves:

Stocks

- The S&P 500 rose 1.9 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 2.9 per cent

- The Dow Jones Industrial Average rose 1 per cent

- The MSCI World index rose 1.5 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2 per cent to US$1.0856

- The British pound was little changed at US$1.2394

- The Japanese yen fell 0.9 per cent to 129.58 per dollar

Cryptocurrencies

- Bitcoin rose 6.4 per cent to US$22,286.92

- Ether rose 6.2 per cent to US$1,640.81

Bonds

- The yield on 10-year Treasuries advanced nine basis points to 3.48 per cent

- Germany’s 10-year yield advanced 11 basis points to 2.18 per cent

- Britain’s 10-year yield advanced 10 basis points to 3.38 per cent

Commodities

- West Texas Intermediate crude rose 1.2 per cent to US$81.31 a barrel

- Gold futures rose 0.3 per cent to US$1,929.60 an ounce