Nov 7, 2019

U.S. stocks hit new highs as China, U.S. said to agree to tariff rollback

, Bloomberg News

BNN Bloomberg's closing bell update: Nov. 7, 2019

U.S. stocks sputtered late in the session Thursday but still managed to close at a record high as traders were whipsawed by conflicting headlines on the progress of trade talks with China.

Early reports that the U.S. and China were prepared to exchange tariff rollbacks pushed the the S&P 500 Index higher throughout the day, but the rally lost some steam after Reuters said the plan was meeting resistance in the White House. White House economic adviser Larry Kudlow later told Bloomberg, “If there’s a phase one trade deal, there are going to be tariff agreements and concessions.”

Before the Reuters report, haven assets from gold to sovereign bonds had been sinking -- along with defensive stocks like utilities and real estate -- as a risk-on mood gripped markets. Copper and crude jumped at least 2 per cent before paring gains.

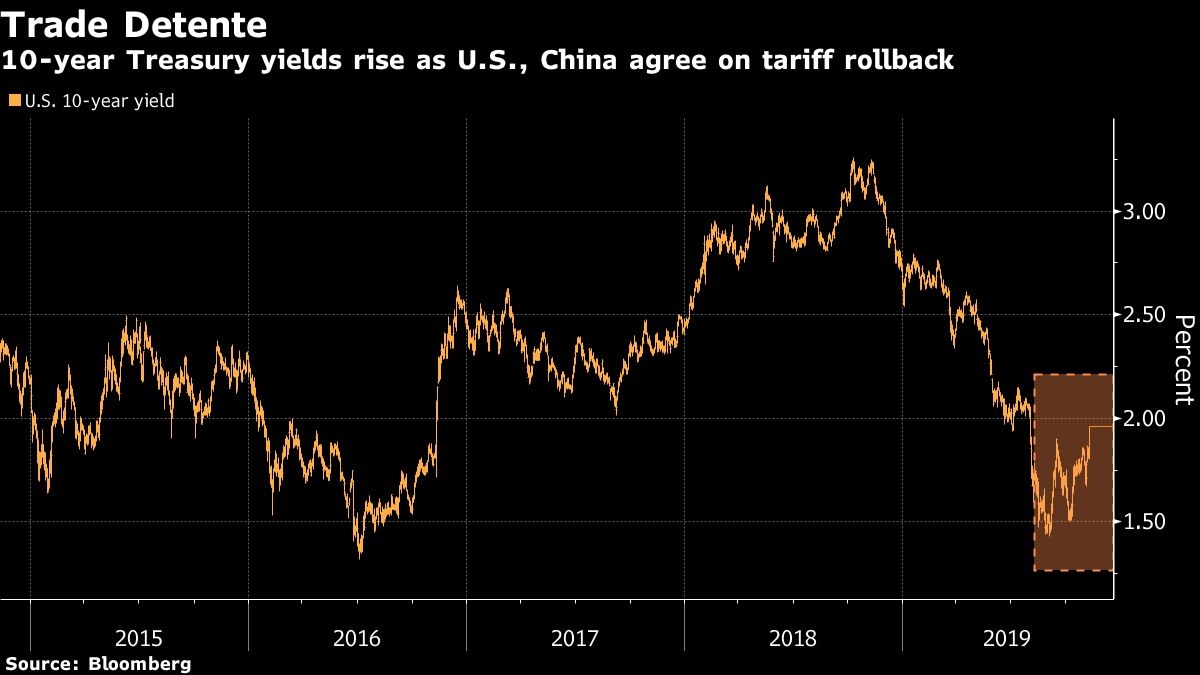

Sovereign bonds plunged around the world on the earlier positive trade news, with the 30-year Treasury yield hitting its highest since August. Ten-year French and Belgian bond yields climbed back above 0 per cent for the first time in months, while the German equivalent surged 10 basis points. Yields remain elevated, even after the latest trade wrinkle. Gold fell nearly US$30 an ounce at one point, only recover some of that loss, but still hit a three-month low.

Risk appetite had been picking up as news of progress on trade helped counter earlier reports that a preliminary accord may not happen this month as the two sides continued to wrangle over a location to sign it. But the latest headlines have left traders to wait for the next bit of news.

“Until it gets signed, I think markets are going to stay cautious, which means you’re not going to price in the best-case scenario,” Chris Gaffney, president of world markets at TIAA, said by phone.

West Texas crude futures traded near US$57 a barrel in New York. The pound weakened after two Bank of England policy makers unexpectedly voted for an interest-rate cut.

Here are some key events coming up this week:

Earnings are due Thursday after the close from Walt Disney Co.

The USDA World Agricultural Supply and Demand Estimates Report for November comes out Friday.

These are the main moves in markets:

Stocks

The S&P 500 Index gained 0.3 per cent to 3,085.37 as of 4:00 p.m. New York time, the highest on record.

The Stoxx Europe 600 Index advanced 0.4 per cent to 406.56, reaching the highest in more than four years on its fifth consecutive advance.

Germany’s DAX Index increased 0.8 per cent to 13,289.46, hitting the highest in more than 21 months with its fifth consecutive advance.

The MSCI Emerging Market Index climbed 0.5 per cent to 1,074.08, the highest in about six months.

Currencies

The Bloomberg Dollar Spot Index gained 0.1 per cent to 1,202.08, the highest in more than three weeks.

The euro fell 0.2 per cent to US$1.1048, the weakest in more than three weeks.

The British pound dipped 0.3 per cent to US$1.2815, the weakest in more than three weeks.

The Japanese yen depreciated 0.3 per cent to 109.27 per dollar, the weakest in more than five months.

The offshore yuan appreciated 0.6 per cent to 6.9682 per dollar, the strongest in 14 weeks on the largest increase in more than 12 weeks.

Bonds

The yield on 10-year Treasuries gained nine basis points to 1.92 per cent, the highest in 14 weeks on the biggest climb in six weeks.

The yield on two-year Treasuries advanced six basis points to 1.67 per cent, the highest in six weeks on the largest rise in four weeks.

Germany’s 10-year yield climbed 10 basis points to -0.23 per cent, the highest in almost four months on the biggest surge in more than 17 months.

Britain’s 10-year yield gained eight basis points to 0.793 per cent, the highest in more than 16 weeks on the largest gain in almost four weeks.

Commodities

West Texas Intermediate crude gained 1 per cent to US$56.91 a barrel.

Gold depreciated 1.5 per cent to US$1,468.09 an ounce, the weakest in more than three months.