Feb 4, 2020

U.S. stocks surge, Treasuries sink on bets over virus impact

, Bloomberg News

BNN Bloomberg's mid-morning market update: Feb. 4, 2020

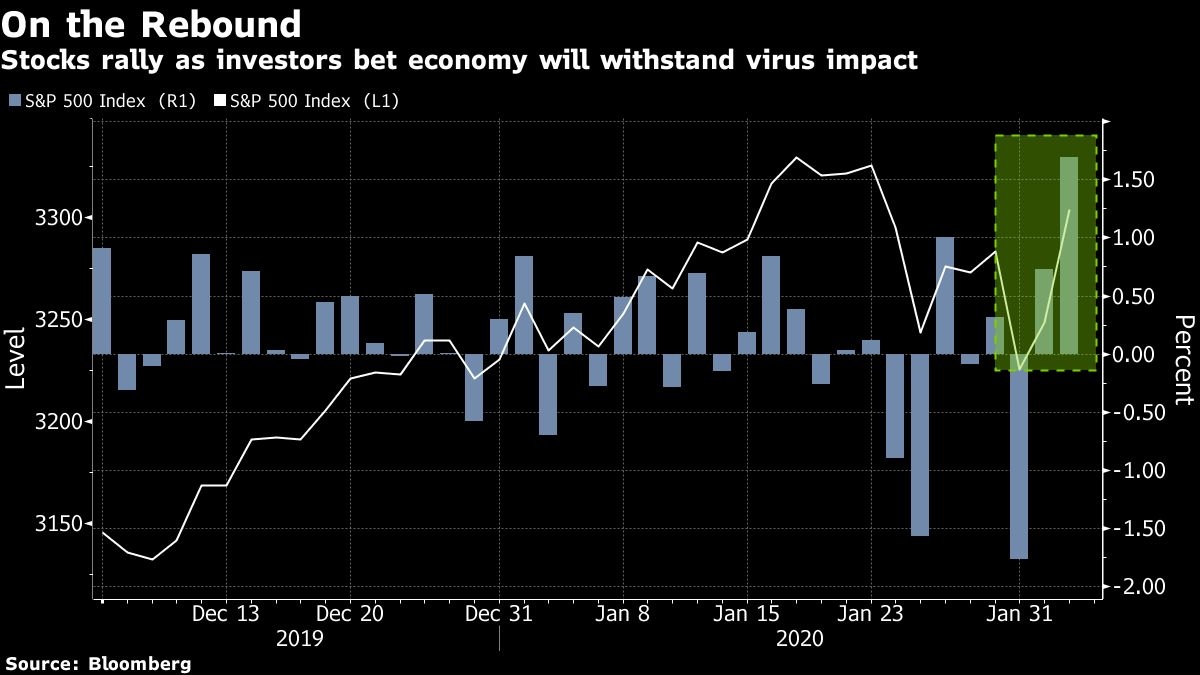

U.S. stocks rallied the most since August, while Treasuries plunged as investors speculated the global economy will withstand any impact from the still-spreading coronavirus after China’s market sell-off eased.

The S&P 500 pushed its two-day gain to 2.2 per cent and the Nasdaq 100 Index hit an all-time high as investors piled back into risk assets after last week’s rout. European and emerging-market shares rallied. Shanghai stocks rebounded from a record US$720 billion wipeout. Treasuries tumbled with gold. Copper in London halted a 14-day slide. Oil bucked the trend, erasing gains that topped 2 per cent. In company news, Tesla Inc. extended its torrid run.

Investors appear to be taking some comfort from the measures Beijing has taken to contain the virus to Hubei province and to support economic growth. Still, travel restrictions continue and business shut-downs mount, with Macau closing casinos for another two weeks. Bulls have focused on strong corporate earnings and assurances of support from central banks. Meanwhile, traders are also waiting for the outcome of the Iowa Caucuses, as the 2020 Democratic presidential race kicks off. Problems with the reporting process have delayed the results.

“The lesson of today’s stock market rally is that while the coronavirus is a risk, it is not a material risk to the economic outlook which backstops corporate earnings always,” said Chris Rupkey, chief financial economist for MUFG Union Bank. “Coronavirus doesn’t increase the odds of a U.S. recession this year.”

Here are some key events coming up:

The U.S. Democratic Party of Iowa on Tuesday will release results from caucuses by 5 p.m. in New York.

Euro-zone PMI data in its final version will be released Wednesday.

The Reserve Bank of India’s interest rate decision is due Thursday.

The U.S. employment report for January is set for Friday release.

These are the main moves in markets:

Stocks

The S&P 500 jumped 1.5 per cent of 4 p.m. in New York.

The Nasdaq 100 added 2.3 per cent to a record.

The Stoxx Europe 600 Index surged 1.6 per cent.

The MSCI All-Country World Index rose 1.6 per cent.

The MSCI Asia Pacific Index surged 1.4 per cent.

Currencies

The Bloomberg Dollar Spot Index edged lower.

The British pound gained 0.4 per cent to US$1.304.

The euro dropped 0.2 per cent to US$1.1043.

The Japanese yen weakened 0.7 per cent to 109.50 per dollar.

The offshore yuan strengthened 0.3 per cent to 6.9944 per dollar.

Bonds

The yield on 10-year Treasuries gained seven basis points to 1.60 per cent.

The two-year yield added six basis points to 1.41 per cent.

Germany’s 10-year yield climbed three basis points to -0.41 per cent.

Commodities

West Texas Intermediate crude fell 0.9 per cent to US$49.68 a barrel.

Gold futures weakened 1.5 per cent to US$1,558.20 an ounce.

LME copper surged 2.2 per cent to US$5,648 per metric ton.

Arabica coffee surged 1.7 per cent to US$1 a pound.