Nov 17, 2022

UK Faces £133 Billion Bill From BOE QE, Wiping Out Last Decade of Income

, Bloomberg News

(Bloomberg) --

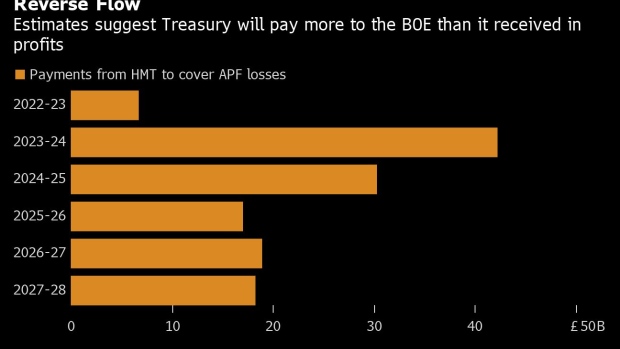

Buried in the latest forecasts for the UK’s economy is how much the government needs to pay the Bank of England for losses on bond holdings: £133 billion ($157 billion).

The hefty sum stems from a deal struck a decade ago that meant the government benefited from any gains on bonds bought by the BOE under its quantitative-easing program, but also needed to cover future losses.

The Treasury has reaped more than £120 billion profit from QE so far, but now it needs to pay after higher rates increased the cost of servicing the debt and a slide in gilts means the BOE is starting to sell the holdings at a lower price than it bought them for.

The Office for Budget Responsibility said Thursday that through 2028 “the Treasury pays £133 billion to cover these losses, more than reversing the previous 13 years’ gains.”

The payments will add to the UK’s troubles in balancing its books, with Chancellor of the Exchequer Jeremy Hunt outlining a £55 billion package of tax rises and spending cuts to plug a hole in the nation’s finances and to restore confidence among bond investors.

Read more: UK’s Fiscal Hole Deepens on Osborne’s QE Accounting Ploy

The OBR said the losses would mean a £61 billion contribution to debt, revised up by £90 billion from March. The terms of the BOE’s buying means the Treasury, and ultimately taxpayers, are on the hook to cover the losses.

--With assistance from Libby Cherry.

©2022 Bloomberg L.P.