Mar 9, 2023

US Household Net Worth Increased in Fourth Quarter on Stock Values

, Bloomberg News

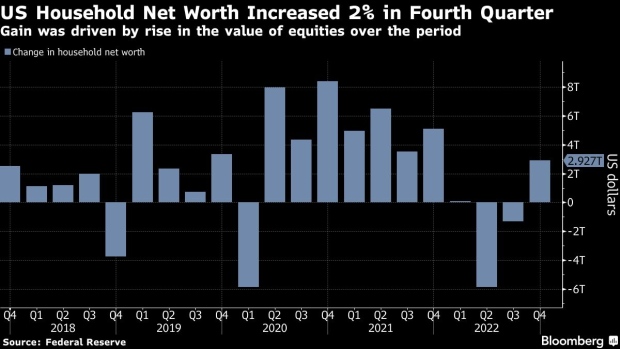

(Bloomberg) -- US household net worth increased in the fourth quarter as a gain in the value of equity holdings more than offset weakness in real estate.

Household net worth climbed nearly $3 trillion, or 2%, in the October-December period to $147.7 trillion after declining the previous two quarters, a Federal Reserve report showed Thursday. That was the biggest advance of the year.

The value of equity holdings advanced $2.7 trillion in the fourth quarter, while the value of real estate held by households fell almost $100 billion.

The S&P 500 climbed through much of the fourth quarter as a gradual cooling in both price growth and the broader economy fueled hopes that the Fed would be able to tame inflation without tipping the economy into a recession. High mortgage rates severely restrained demand for homes — a key source of wealth for Americans — and selling prices have begun to fall.

Since then, however, consumer spending has rebounded and inflation has re-accelerated, driving expectations that policymakers will have to raise rates higher — and potentially at a faster pace — than previously expected. Mortgage rates are expected to increase as a result, something that is likely to put even more pressure on the housing market.

The Fed’s report also showed household checkable deposits, or the money Americans have in checking, savings and money market accounts, climbed to almost $4.8 trillion at the end of 2022 from $4.1 trillion a year earlier. Those excess savings have been a key driver of the resilience in consumer spending, despite high inflation.

Consumer credit not including mortgages rose at a 7% annual rate in the fourth quarter.

Business debt outstanding grew an annualized 3.6%, the slowest pace in six quarters. At the same time, state and local government debt decreased at a 5.2% rate, while federal government debt grew at a slower pace from the previous three-month period.

(Adds graphic)

©2023 Bloomberg L.P.