Apr 18, 2023

US Housing Starts Decline, Dragged Down by Multifamily Units

, Bloomberg News

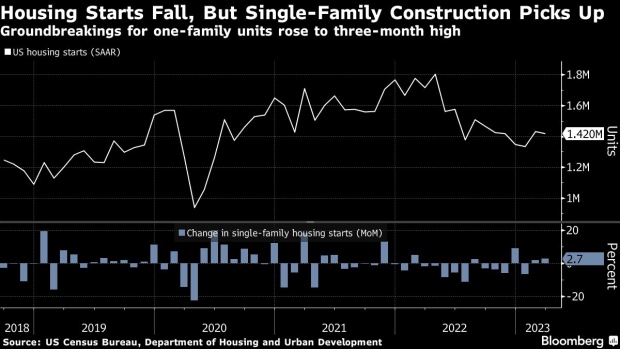

(Bloomberg) -- US housing starts fell in March as a pullback in multifamily projects more than offset a pickup in construction of single-family homes.

Beginning home construction fell 0.8% to a 1.42 million annualized rate, according to government data released Tuesday. Multifamily starts dropped 5.9%, while single-family homebuilding increased 2.7% to a three-month high.

The rise in one-family home construction may reflect builders’ efforts to stoke demand after a spike in borrowing costs sidelined many prospective buyers. With inventories constrained in the resale market, homebuilders have an opportunity to fill the void with new construction.

However, the industry faces headwinds that include tighter loan standards for borrowers and mortgage rates that are twice as high as they were at the end of 2021.

Applications to build, a proxy for future construction, dropped 8.8% to an annualized rate of 1.41 million units due to fewer permits for multifamily projects. However, permits for one-family dwellings advanced to a five-month high.

The pickup in single-family home construction reflected gains in all regions but the West. In the South, the pace was the fastest since June, while Midwest starts were the strongest in five months.

The number of homes completed declined 0.6% to a 1.54 million pace. The level of one-family properties under construction dropped to the lowest since August 2021, suggesting it will take time to boost inventory.

The housing starts data will help allow economists tweak their estimate of home construction’s impact on first-quarter gross domestic product. Prior to the report, the Federal Reserve Bank of Atlanta’s GDPNow estimate called for residential investment to subtract 0.2 percentage point.

Existing-home sales data for March will be released on Thursday, while a report on new-home purchases is due next week.

--With assistance from Reade Pickert and Kristy Scheuble.

(Adds graphic)

©2023 Bloomberg L.P.