Jul 2, 2022

US Jobs Report Seen Showing Resilient Labor Demand: Eco Week

, Bloomberg News

(Bloomberg) -- Employers in the US probably added workers at a more moderate yet still healthy pace last month as the jobless rate held near its lowest level in decades, suggesting resilient labor demand even as the economy cools.

The government’s latest payrolls tally on Friday is projected to show a 273,000 increase for June, based on the Bloomberg survey median. The unemployment rate is seen staying at 3.6%, while average hourly earnings probably rose 5% from a year ago.

Wage growth running well north of its long-run average and steady hiring suggest Federal Reserve policy makers will forge ahead with another 75 basis point rate hike this month. Investors will gain some insight into their thinking in minutes from the June meeting, due to be published on Wednesday.

Data earlier that day are expected to show that job openings remained elevated in May, indicating companies still want to hire despite a softening in economic activity and concerns about the outlook.

The number of vacancies is seen easing to 11 million from 11.4 million in April. That’s still close to the record 11.9 million in March. Labor market tightness is a concern for Fed officials because it risks feeding into a spiral of faster wage growth and inflation.

Among other US economic data in this holiday-shortened trading week: the Institute for Supply Management will issue its services index for June, and the Fed will report on May consumer borrowing. The government’s May trade deficit figures are also due.

What Bloomberg Economics Says:

“Even if ‘soft landing’ ultimately proves as taboo a term as ‘transitory inflation,’ there are reasons to think the job market will not fall off a cliff this year. Openings are high and decelerating economic growth reflects uneven patterns beneath the surface. Service-sector recovery is still under way, favoring sectors like leisure and hospitality, along with education and health services.”

--Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger, economists. For full analysis, click here

Elsewhere, the European Central Bank will release minutes of its June deliberations, Brazil’s double-digit inflation may have ticked up again, and Canada also publishes jobs data. Monetary officials in Australia, Israel, Peru and Poland are among those forecast to keep raising rates.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Asia

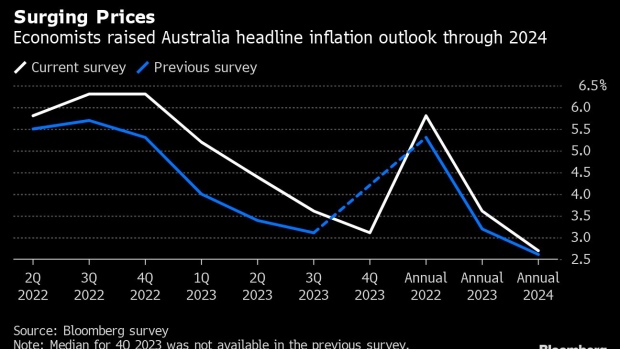

The Reserve Bank of Australia meets Tuesday, with another rate hike expected as inflation continues to surge. Consumer confidence is sliding, and questions remain over how strong the central bank’s resolve will remain over taming runaway prices.

South Korean inflation figures are due the same day. The country’s finance minister has already warned that price growth is set to top 6% in the coming months.

In Japan, Prime Minister Fumio Kishida will find out whether wages are keeping up with prices ahead of a national election he wants to win convincingly to shore up his leadership.

After that, household spending data out Friday will show if inflation is starting to weigh on a post-pandemic recovery in consumption.

Malaysia’s central bank meets on Wednesday, and monetary authorities in the embattled economies of Pakistan and Sri Lanka set policy later in the week.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

Fresh from their annual retreat in the Portuguese resort of Sintra, ECB policy makers will continue talks on the development of a new anti-crisis tool as they prepare to hike rates, with a quarter-point increase on July 21 considered a “done deal” by some.

On Thursday, minutes of their June decision, which came before the pledge to create a crisis measure, could offer clues about their intentions. Events which may also provide opportunities are appearances by Vice President Luis de Guindos and Bundesbank Chief Joachim Nagel on Monday, and President Christine Lagarde on Friday.

While a new record for euro-area inflation, 8.6% in June data released on Friday, could embolden them with hiking, the ECB will also want to look at the health of growth. That may throw focus on numbers from Germany, the region’s biggest economy. Export data on Monday, factory orders on Wednesday and production on Thursday might grab their attention.

Central banks in Eastern Europe are already well along with tightening, and that’s predicted to continue in the coming week. Romanian officials may raise rates by 75 basis points on Wednesday, and Polish policy makers could do the same the next day.

Further south, Israel is expected to raise its key rate by at least 50 basis points on Monday, when Governor Amir Yaron will also provide forecasts.

In Turkey, data the same day is expected to show annual inflation got closer to 80% in June, as the central bank persists with its unorthodox low-rates policy. The price outlook could be further complicated by plans to raise the minimum wage to restore some purchasing power to low-income workers.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Colombia and Mexico post the minutes of their latest monetary policy meetings, where each central bank raised by a record amount.

The former increased borrowing costs by 150 basis points to 7.5%, with the latter delivering a hike of half that size to put the key rate at 7.75%. Economists see a good chance the famously hawkish Banxico will match its June move in August.

Uruguay’s central bank is expected to raise borrowing costs for an eighth straight meeting, while Peru is all but certain to extend a record tightening cycle, likely with a half-point hike to 6%.

Brazilian industrial output figures for May look likely to firm up from weak April levels.

Analysts expect June data to show that inflation in Colombia pushed past 9.6%, which would be the fastest pace since 2000, and to a fresh two-decade high of nearly 8% in Mexico.

Closing out the week, preliminary forecasts see the June readings from Chile and Brazil serving up alarm and disappointment respectively.

Chile’s consumer prices may have surged 12.6% from a year earlier -- a 27-year high -- while in Brazil they may have ticked back up near 12% as inflation in both economies has largely brushed off record tightening cycles.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

©2022 Bloomberg L.P.