May 3, 2023

US Service Industry Expands at a Modest Pace as Activity Cools

, Bloomberg News

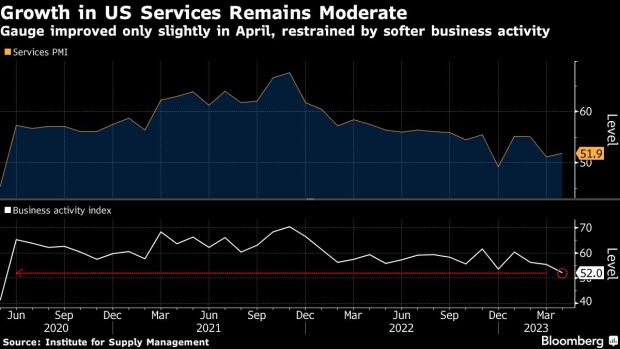

(Bloomberg) -- The US service sector expanded only modestly in April, restrained by the weakest pace of business activity in nearly three years.

The Institute for Supply Management’s overall gauge of services edged up to 51.9 last month from 51.2 in March, according to data out Wednesday. Readings above 50 indicate growth. A measure of prices paid held close to the lowest level since 2020.

The business activity index fell 3.4 points to 52, still indicating growth but the slowest pace since May 2020. The third-straight decline in the gauge that parallels the ISM factory output index suggests softer demand for services.

Combined with the latest ISM report showing manufacturing contracted for a sixth month, the services data underscore an economy struggling for momentum amid higher interest rates and still-elevated inflation.

One bright spot in the services report was a pickup in a measure of new orders, which climbed nearly 4 points to 56.1 and suggested demand continues to grow, albeit slowly.

Fourteen industries reported growth in April, led by entertainment and recreation, other services, real estate, and accommodation and food services. Three industries reported a decrease.

“The majority of respondents are mostly positive about business conditions; however, some respondents are wary of potential headwinds associated with inflation and an economic slowdown,” Anthony Nieves, chair of the ISM Services Business Survey Committee, said in a statement.

While the ISM’s index of prices paid for inputs ticked up in April, it remained near the lowest level since July 2020. At 59.6, the index indicates inflationary pressures are easing.

Select ISM Industry Comments

“Lead times are improving. Suppliers are struggling with how to position themselves with pricing; those keeping prices higher despite a drop in input costs are at risk of losing their business to those that are willing to adjust prices in line with lower input costs.” - Accommodation & Food Services

“High mortgage rates continue to weigh on new residential construction. With demand down, material suppliers are curtailing production to maintain pricing levels.” - Construction

Inflation concerns have “our company maintaining a cautious approach to the future.” - Management of Companies & Support Services

“Retail environment is lower year over year, but trends are stable year to date. Inventory levels are coming more in line to match the new lower demand trends.” - Retail Trade

“Material prices continue to decline — except for energy and chemicals — but are still above pre-pandemic levels. Inflation and recession uncertainties still weigh on decisions.” - Utilities

“Prices are coming down, but the decreases are small and not materially close to 2019 pricing. Labor in general is still and issue.” - Transportation & Warehousing

“Business activity remains relatively flat compared to last month. Inventories are much more balanced versus demand, and supply chains are near full recovery. Optimistic about demand and business activity in later spring and summer months.” - Wholesale Trade

The report also showed the pace of hiring at service providers moderated further in April. The group’s employment gauge slipped to 50.8, suggesting modest increases in headcount.

The government’s monthly jobs report on Friday is forecast to show employers scaled back hiring. Economists also see the unemployment rate ticking up slightly from historically-low levels.

A measure of inventories at service providers slipped back below 50, indicating declines. A separate gauge showed respondents viewed their stockpiles as being modestly lean. Both measures suggest services are making progress on any inventory overhang.

(Adds ISM industry comments)

©2023 Bloomberg L.P.