Sep 6, 2022

US Services Gauges Show Largest Split Message Since 2020

, Bloomberg News

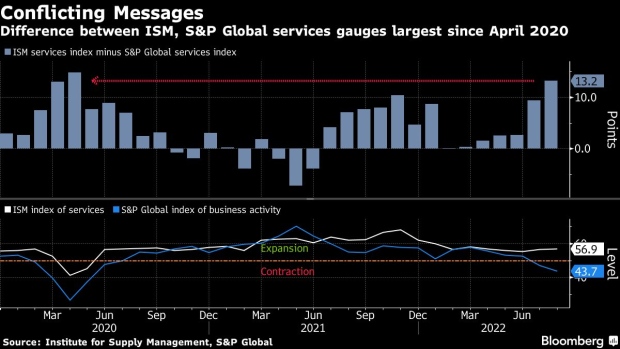

(Bloomberg) -- The most striking divergence in two prominent gauges of US services activity since April 2020 can probably be traced in large part to what types of companies are surveyed and differences in methodology.

The Institute for Supply Management’s services index unexpectedly improved to 56.9 last month, while S&P Global’s final August gauge of business activity dropped to 43.7. In both surveys, a reading of 50 is the dividing line between expansion and contraction.

The last time the ISM measure exceeded the S&P Global gauge by that much was during the depths of the pandemic in April 2020.

“Overall, while our tracking models suggest that the risks of recession over the next year or so are rising, we still think the economy is more likely to see a period of below-trend growth rather than an outright contraction,” said Andrew Hunter, senior US economist at Capital Economics.

On its face, the ISM report covers a greater number of industries than its counterpart. The S&P Global survey excludes retail and wholesale trade, construction, mining, utilities, agriculture and various government administration. ISM includes all those industries.

Moreover, the ISM gauge is a composite reading based on four equal-weighted indexes that include business activity, new orders, employment and supplier deliveries. The group’s survey is sent to its Services Business Survey Committee members, who are asked to report on just their US operations.

The S&P Global measure doesn’t aggregate subindexes and instead calls its business activity gauge the primary measure of overall output in the services economy.

“It is most useful to look at the signal from a broad set of survey indicators together rather than focus on any one individual survey as being the ‘correct’ gauge of the economy,” Daniel Silver, economist at JPMorgan Chase & Co., said in a note.

“And we should also keep in mind that while the ISM survey data have looked stronger than the PMI data lately, the ISM data still show clear cooling in recent months relative to readings from late last year,” Silver said.

©2022 Bloomberg L.P.