Nov 15, 2023

US Shoppers Take a Breather, Prices Ease in Sign of Cooling Economy

, Bloomberg News

(Bloomberg) -- Shoppers took a breather in October after a summer spending flurry and inflationary pressures abated, pointing to a gradual cooling of the economy the Federal Reserve is hoping for.

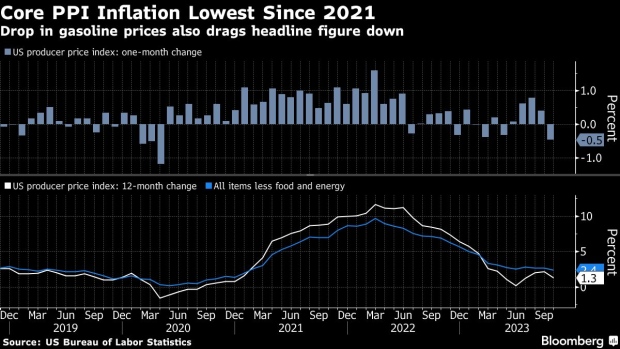

Receipts at the nation’s retailers slipped 0.1%, less than forecast, after sales in each of the prior two months were revised higher. The government also reported in a separate release that the producer price index last month unexpectedly fell 0.5%, the most since April 2020 and helped by a plunge in gasoline costs.

Wednesday’s reports followed consumer-price data showing inflation is broadly slowing and recent figures indicating tempered job growth, suggesting the economy is on track for a soft landing.

“Along with the encouraging October CPI report and healthy slowing in employment growth, the pullback in consumer spending after the summer spending spree will give the Federal Reserve comfort that their restrictive monetary policy stance is reducing inflationary pressures,” Kathy Bostjancic, chief economist at Nationwide Mutual Insurance Co., wrote in a note.

So-called retail control group sales — used to calculate gross domestic product — rose 0.2% after an upwardly revised 0.7% advance a month earlier. That suggests the fourth-quarter economy is off to a decent start, following a spending surge in the prior period.

“Consumer spending will continue to grow in 2024, but at a modest pace,” Bill Adams, chief economist at Comerica Bank, said in a note. “The economy has a good shot at returning to a more normal rate of inflation and pace of growth without slipping into recession.”

Seven out of 13 retail categories posted declines, led by furniture and car dealers. Gasoline sales weren’t as big of a drag on the headline number as feared considering how much pump prices fell in the month. Outlays increased at personal-care and grocery stores.

The resiliency of the US consumer — the main engine of the economy — has continuously surprised economists, leading many to rethink their recession forecasts. But it’s unclear how much of that can be sustained given a cooling job market, lingering inflation and higher borrowing costs.

Target Corp. sales dropped for a second consecutive quarter as customers curbed spending on some discretionary categories, but Chief Executive Officer Brian Cornell said Wednesday that the big-box retailer sees “great resiliency” in the face of mounting challenges for consumers.

Meanwhile, the Labor Department’s PPI report showed a 1.3% increase in overall wholesale prices from a year ago, while the core gauge posted the smallest annual increase since the start of 2021.

Over 80% of the decrease in goods prices was due to a 15.3% slump in the cost of gasoline. Services costs, meanwhile, were flat after rising six straight months.

While the cost of labor and many other inputs remain elevated, annual producer price growth has eased since early 2022 amid normalizing supply chains and a broader shift in consumer spending toward services.

Wednesday’s reports “feeds the soft landing narrative with subdued price pressures and resilience in activity,” James Knightley, chief international economist at ING Financial Markets, said in a note.

--With assistance from Reade Pickert.

©2023 Bloomberg L.P.