Feb 22, 2020

Victoria’s Secret Is Contrarian Bet on Bricks, Mortar, Lingerie

, Bloomberg News

(Bloomberg) -- Victoria’s Secret is an ailing American retailer tarnished by scandal with a link to a notorious sex offender. Sycamore Partners is all in.

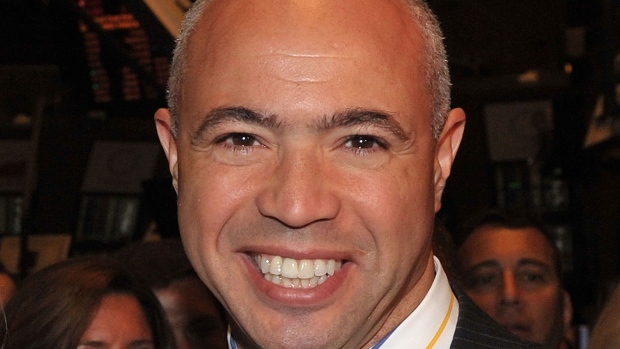

The private equity firm run by Stefan Kaluzny agreed to buy a 55% stake from L Brands Inc. that values the lingerie seller at $1.1 billion.

The deal is going down as retail bankruptcies pile up like roadkill. Victoria’s Secret has the added burden of a reputation problem -- it faces misconduct allegations, accusations of misogyny and a connection between L Brands Chief Executive Officer Leslie Wexner and the convicted child procurer Jeffrey Epstein, whose purported jail suicide made international headlines. That’s all on top of years of slumping sales.

“Before all the brouhaha and all the social issues, there was a fundamental issue of the brand and the brand relevance in the U.S.,” said Wendy Liebmann, CEO of consulting firm WSL Strategic Retail. “If you’re not relevant, it doesn’t matter what money you put into it.”

Kaluzny is betting his firm can reverse the decline. Sycamore is arguably the most successful private equity operator specializing in retail, but given all the corpses littering the landscape, that could be damning with faint praise. Despite Kaluzny’s reputation as a retail whisperer for resuscitating floundering store chains, this is a contrarian gamble for his $15 billion firm.

“Sycamore believes in the future of brick and mortar,” said Michael Stone, chairman and co-founder of branding firm Beanstalk.

Sycamore, and Kaluzny, declined to comment.

This isn’t Sycamore’s first flier on physical stores in the age of online shopping. Its investments include Hot Topic, a youth-oriented, music-themed apparel retailer, clothing chain Talbots, office-supply seller Staples and Belk, a department-store chain in the South.

Kaluzny follows the buyout playbook, which relies on acquiring bedraggled retailers with borrowed money. In the last few years, several of Sycamore’s portfolio companies have filed for Chapter 11 protection, unable to repay the debt Sycamore issued through them to fund the buyouts.

Going Big

After Sycamore purchased a stake in Aeropostale Inc. in 2013, the clothing-store chain accused Sycamore of driving it into bankruptcy to facilitate an inexpensive takeover. Sycamore denied those claims and a judge ultimately dismissed them. Sycamore went on to bid on Aeropostale in bankruptcy, but didn’t win.

A group of investors criticized Sycamore in 2018, saying it left apparel company Nine West Holdings Inc. insolvent after buying its parent. The group dropped its claims in return for a $120 million payment from Sycamore.

In the past, Kaluzny has gone big, even when observers say it’s too big. A case in point is Staples Inc., the office-supplies seller Sycamore agreed to buy in 2017 for $6.9 billion, its biggest-ever takeover. Less than two years later, Kaluzny hammered out a refinancing deal that funded a $1 billion dividend to his firm. Even the most seasoned buyout experts were stunned at the deal’s speed and the amount Sycamore was paying itself.

Talbots was a success for Sycamore. After costly forays into men’s and young women’s fashions pushed the clothing chain toward bankruptcy, Sycamore swooped in with a fire-sale offer in 2012 after everyone else backed away. Kaluzny quickly refocused the company on its core demographic -- older, well-to-do women who favor traditional basics like blazers, ballet flats and pearls. By 2017, the investment netted a more than sixfold return on capital for Sycamore and its backers.

With Victoria’s Secret, Kaluzny apparently got a good deal. Wall Street expected a higher valuation than what he negotiated for his stake. Odeon Capital called the valuation “unfortunate.”

Daunting Retail

Still, recent returns show how daunting retail has become. Sycamore’s $2.5 billion fund, launched in 2014, has returned 10.4% as of June 30, 2019, according to data provided by the Regents of the University of California, which is lower than the 15.4% median internal rate of return for 2014 buyout funds, according to data compiled by Bloomberg. Compare that with Sycamore’s first fund, launched in 2011. It delivered an annualized net return of 29.1% through June 30, compared with a 13.45% average of other funds, according to data compiled by Bloomberg.

Kaluzny, as is typical for the media-shy managing director, is keeping his Victoria’s Secret blueprint under wraps. Wexner, who will step down as chairman and CEO of L Brands when the deal closes, said Sycamore will bring a “fresh perspective and greater focus to the business.” L Brands is keeping a 45% stake in the lingerie seller.

The deal distances Victoria’s Secret from Wexner and Epstein, who served as a sort of charge d’affaires for Wexner. That will be helpful, said Beanstalk’s Stone, as the company looks to repair an image besmirched as recently as this month, when models and executives said they were bullied and harassed for decades.

“Brands can reinvent themselves,” Stone said. “I think it’s a brand that’s not going to go away.”

--With assistance from Jordyn Holman and Samuel Brechtel.

To contact the reporters on this story: Sally Bakewell in New York at sbakewell1@bloomberg.net;Lauren Coleman-Lochner in New York at llochner@bloomberg.net;Crystal Tse in New York at ctse44@bloomberg.net

To contact the editors responsible for this story: Crayton Harrison at tharrison5@bloomberg.net, Bob Ivry, Larry Reibstein

©2020 Bloomberg L.P.