Sep 13, 2022

Wall Street Model of Japanese Banks Under Scrutiny as Rates Rise

, Bloomberg News

(Bloomberg) -- Japanese banks’ success in taking on Wall Street to offer loans in the US is drawing regulatory attention as the cost of dollar funding rises.

Faced with ultra-low interest rates and tepid loan demand at home, Japan’s banks have been ramping up corporate lending and bond underwriting overseas. The biggest, Mitsubishi UFJ Financial Group Inc., is on track to overtake Goldman Sachs Group Inc. to rank in the top five for US loans this year.

Rapid rate hikes by the Federal Reserve are now making dollar funding a critical issue for the lenders, putting them at a disadvantage to US rivals, a senior official at Japan’s financial regulator said.

“We need not only to watch the volume and costs of funding, but also to monitor and discuss their business model,” Toshinori Yashiki, deputy director-general at Japan’s Financial Services Agency, said in an interview.

Securing dollar funding has long been a challenge for Japan’s lenders since they can’t count on deposits from retail clients across the US. The banks mostly get their dollars from corporates or other institutions at a higher cost. Banks that would like to borrow dollars in the market or offer yen funds in exchange for dollars for three months have to pay an annualized rate of more than 3%, according to data compiled by Bloomberg.

Yashiki said the matter gained a renewed urgency this year, as the Fed is reversing the massive monetary easing that prevailed for more than a decade following the financial crisis.

“In an ultra-low interest rate era, there was little difference between Japanese and US banks,” he said. “But with interest rates rising this high, I think Japanese banks are clearly at a disadvantage, given they don’t have (retail) deposit funding.”

Apart from Mitsubishi UFJ, Mizuho Financial Group Inc. is on pace for 9th and Sumitomo Mitsui Financial Group Inc. 15th this year in US loans, according to data compiled by Bloomberg. Five years ago, Japan’s three biggest lenders ranked 11th, 17th and 30th respectively.

Instead of exclusively arranging debt before packaging it for sale to others, Japan’s banks often keep loans on their books. A balance sheet expansion may expose lenders to greater risks if dollar funding dries up or borrowers default in times of economic stress.

In response, they’ve been increasing deposits from corporate clients by building up transaction banking services and expanding loan origination and distribution businesses that tie up less of their own capital.

The sharp US rate rises have also created causes of concern for other areas, Yashiki said, citing non-investment grade overseas debt as one example, where borrowers were at risk in previous cycles.

“I don’t know whether the non-investment grade sector will be hit this time or not,” he said. “But it’s a fact that they are vulnerable, and we will monitor closely.”

Riskier Debt

Japan’s three megabanks have been pushing into such riskier business in a search for profit. In April, Mizuho said it plans to hire bankers to build its businesses with non-investment grade companies and leveraged buyout financing, where returns are expected to be higher.

Yashiki, a veteran regulator who in his college days was an American football player at Kyoto University, said the the closer scrutiny does not necessarily mean the regulator is frowning on the business.

“In order for them to serve properly as financial intermediaries in Japan, I understand they need to pursue profits,” he said. “And I won’t oppose them seeking part of that in overseas non-investment grade business.”

Bond Holdings

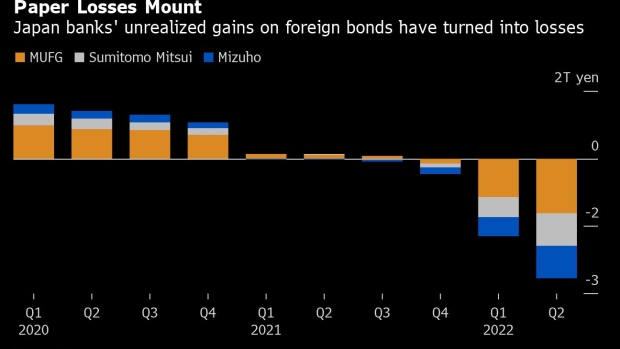

Still, the more immediate impact of US rate hikes has been felt in the banks’ foreign bond holdings, with billions of dollars in losses on their portfolios and billions more in unrealized markdowns.

The regulator is concerned about the banks’ portfolios of bonds and other securities because their performance could affect the lenders’ financial health given their size, Yashiki said.

“We think it’s inevitable to have unrealized losses depending on interest rate environments,” he said. “The important thing is to have these losses within their risk management capacity.”

(Adds cost of dollar funding in fifth paragraph)

©2022 Bloomberg L.P.