May 12, 2021

Wall Street Will Keep Gorging on SPAC Fees Long After Boom Fades

, Bloomberg News

(Bloomberg) -- Wall Street will continue reaping rewards from its embrace of blank-check companies for a long time, even if the record-breaking boom in listings comes to an end.

Investment banks have earned as much as $15 billion from underwriting and advisory work with special purpose acquisition companies since the start of last year, according to research firm Coalition Greenwich. At least $8 billion of that revenue hasn’t been booked yet and will show up in banks’ results over the next two years, the data show.

One of the main reasons is that arrangers of blank-check IPOs in the U.S. get paid in chunks, with less than half of their typical 5.5% fee paid when a listing is completed. The rest is deferred until after the SPAC finds a target -- which can take up to 24 months -- and completes the merger.

That’s good news for top SPAC houses like Citigroup Inc., Goldman Sachs Group Inc. and Credit Suisse Group AG at a time when regulatory challenges are starting to send a chill through the market. Previous SPAC listings will provide “a very strong tailwind” to equity capital markets revenues through 2022, said Amit Goel, co-head of European banking research at Barclays Plc.

“It’s not game over for the banks,” said Nikolai Roussanov, a finance professor at the University of Pennsylvania’s Wharton School.

Blank-check companies completed $181 billion of U.S. listings over the last five quarters, accounting for 55% of all IPO fundraising in New York, according to data compiled by Bloomberg. At the peak of the frenzy, more than 50 SPACs unveiled plans to raise a combined $17 billion during a single week in February.

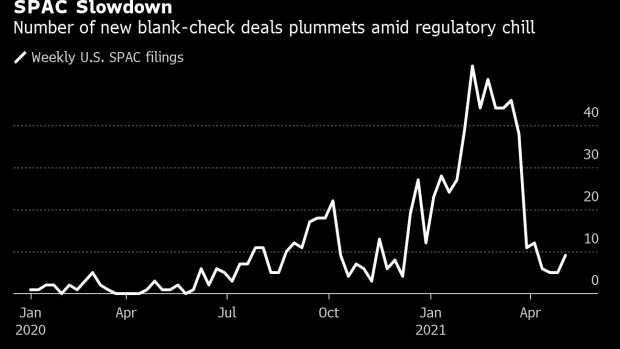

The pace of new deals has now slowed to a trickle, with only five blank-check companies submitting registration documents in the last week of April. U.S. regulators have been warning investors for months about the potential risks around SPACs. Last month, they spooked dealmakers by floating the potential of different accounting treatment for one aspect of SPAC deals, a move that has forced many companies to review their results.

While deferred underwriting fees will still be rolling in over the coming quarters, regardless of these hurdles, there are risks to the as-yet-unbooked revenue. Chief among these are the possibility that a SPAC doesn’t find a target, or that a large number of the SPAC’s investors redeem their holdings before a deal goes through.

Still, most of those fees will find their way to banks’ top lines, said Eric Li, Coalition Greenwich’s London-based head of transaction banking.

Banks also have a variety of other avenues to earn money from blank-check companies that are already trading, from helping them find targets to advising the startups seeking to list via SPACs. Others will work on arranging a share sale -- known as a private investment in public equity, or PIPE deal -- to support the merger.

Even relatively unknown players are getting a slice of the pie. Continental Stock Transfer & Trust Co. has carved out a profitable niche holding the cash for many SPACs, which are required to keep their assets in trust until an acquisition target is found.

“Banks have been under assault for a long time by fintech, by a decline in interest rates over thirty-plus years, by globalization and global competitors,” said Mark Yusko, chief executive officer of Morgan Creek Capital Management. “There is plenty for banks to worry about. A temporary slowdown in SPAC issuance is not one of them.”

Some executives have recently sounded a hopeful note on future SPAC revenues. Deutsche Bank AG boss Christian Sewing last month touted the “enormous dynamics” around the firm’s blank-check business. He pointed to the prospect of future SPAC work for its advisory unit, saying that business shouldn’t be underestimated, even if the fees going to its ECM franchise decline over time.

Europe has also been seeking to attract more SPACs while the pace of deals slows in New York. Amsterdam is emerging as the venue of choice for some of region’s highest-profile blank-check listings. Frankfurt and Paris have also been seeing success, and London is considering changing its rules to become more attractive. Even Nasdaq Inc.’s Nordic bourse has set up a new framework for such offerings.

“SPAC IPOs might not ever return to orders of magnitudes we’ve seen, but they aren’t going away,” Wharton’s Roussanov said.

©2021 Bloomberg L.P.