Sep 26, 2023

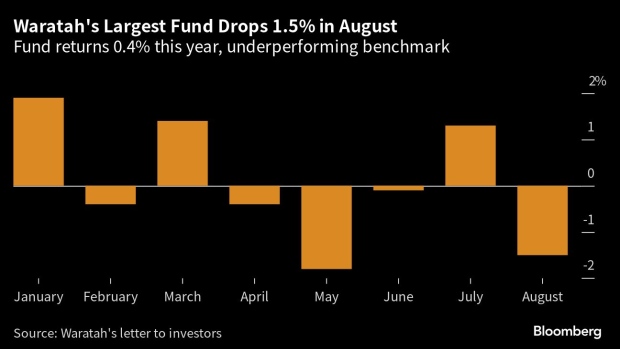

Waratah’s Biggest Fund Fell 1.5% in August, Paring 2023 Gain

, Bloomberg News

(Bloomberg) -- Waratah Capital Advisors’ largest hedge fund dropped 1.5% last month, wiping out most of its gains this year.

The Waratah Performance fund advanced just 0.4% through August, according to an investor letter seen by Bloomberg, trailing the 12.8% return for a benchmark that includes the S&P 500 and Canada’s TSX Composite Index.

“A raging bull market, narrowly led by a few names, isn’t usually my time to shine,” Waratah Chief Investment Officer Brad Dunkley said in a separate note to investors. “I consider myself to be a rational and patient investor with a preference for unexciting but attractively valued businesses.”

The largest long exposures in the C$908 million ($672.1 million) Waratah Performance fund were Sun Communities Inc., which rose 0.9% in August, and Microsoft Corp., which tumbled 28%.

This month, US stocks have lost some of their 2023 gains as hotter-than-expected inflation data has investors betting the Federal Reserve may raise interest rates again.

Waratah’s long-biased fund, with C$649 million of assets under management, fell 0.3% in August, trimming its year-to-gain to 1.7%. It’s largest long exposures include Dream Unlimited Corp. and Canadian Natural Resources Ltd.

Two flagship funds, Waratah One and Waratah One X, both rose 0.5% last month, trimming their declines so far this year to 1.9% and 3.5%, respectively.

The Toronto-based firm, founded by Dunkley and Blair Levinsky, manages C$4.7 billion for wealthy individuals, family offices, foundations and pension funds across its hedge funds and private equity strategies, according to its website.

--With assistance from Geoffrey Morgan.

(Updates with CIO comments in third paragraph.)

©2023 Bloomberg L.P.