Dec 4, 2023

Warburg Pincus Reshuffles Leadership in Asia to Tap Growth

, Bloomberg News

(Bloomberg) -- Warburg Pincus is tapping a new boss to oversee its entire Asia private equity business, placing a region that’s increasingly complex to navigate under one chain of command.

Vishal Mahadevia, a Warburg veteran since 2006 and the firm’s India chief, will become head of Asia private equity, the company said Monday. It’s part of a sweeping overhaul of Asia top brass at the firm. Warburg is also naming new heads in China, India and Southeast Asia.

Warburg is pushing to unify decision-making in a bid to keep growing on the continent. “We always want to best assess the risks and reward across the region,” said Warburg President Jeff Perlman. The former head of Southeast Asia who played a key role building the Asia property business, Perlman was elevated this year and crowned chief executive officer heir-apparent.

Warburg is the latest global alternative asset manager reshuffling leadership in Asia and taking a hard look at how to mobilize there.

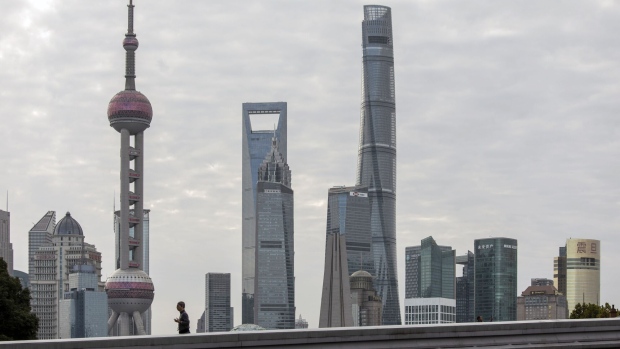

China’s real estate crisis, regulatory crackdowns and rift with the US are forcing foreign investors to reassess prospects for returns, while India’s upcoming election will bring market volatility. The value of private equity deals in the Asia-Pacific region plunged 44% in 2022, ending two years of record dealmaking, according to Bain & Co. Meanwhile, firms had a harder time cashing out of bets.

China Shifts

Warburg’s China head Frank Wei is stepping down from the role after more than 20 years at the firm. Min Fang and Ben Zhou will be co-heads of the China private equity business. The China changes were first reported on local social media.

The company further pared back its China team by about five dealmakers, including its Shanghai-based partner and consumer head Jericho Zhang, after letting go about seven others mostly focused on consumer or internet investments in late 2022, a person familiar with the matter said.

Warburg was one of the earliest US private equity firms to enter Asia with its first deals in China in the 1990s. Asia now makes up about a third of Warburg’s more than $84 billion of assets, with the company equally exposed to China and India. It has made successful bets on India telecommunications giant Bharti Airtel Ltd. and Chinese industrial real estate business ESR. Warburg’s investment in China’s Ant Group Co. proved costly after the fintech firm ended up in Beijing’s crosshairs.

Top executives have taken a more cautious view on the Chinese consumer, said people familiar with the matter. They predict that many have wealth and savings tied up in slumping real estate, and spending will be depressed for years to come.

“We recognize that what made China so economically successful for the last forty years is shifting,” Warburg CEO Chip Kaye said in an interview. “Those changes create opportunity amidst the uncertainty.”

The firm said it is still committed to China. Kaye added it will be “business as usual” for Warburg in China and India, with Southeast Asia remaining in key focus.

As US firms slow investments in China and reach more into India, Australia and other parts of Asia, a new crop of dealmakers are rising. In June, KKR & Co. elevated Gaurav Trehan as sole head of private equity for Asia-Pacific, giving him new responsibilities on top of his role as India head.

As part of the latest raft of changes at Warburg, Saurabh Agarwal will head Southeast Asia private equity. The firm has said that Takashi Murata will join in 2024 to lead the Japan business and co-head Asia real estate alongside firm veteran Ellen Ng. The company has 40% of its Asia investments in property bets.

In addition to his new responsibilities as Asia private equity head, Mahadevia will continue to co-head financial services. Narendra Ostawal will become head of the India private equity business.

Other dealmakers in India were also given bigger role in parts of the firm’s global portfolio, which continues to grow.

“The investors who are successful in Asia are going to be diversified,” said Kaye.

(Updates with context about deal slowdown in fifth paragraph. In a previous version, Warburg Pincus corrected quote in fifth paragraph after ‘China Shifts’ subheadline)

©2023 Bloomberg L.P.