Jan 29, 2024

Weed Sales Boom in Dry January As People Drink Less

, Bloomberg News

(Bloomberg) -- Increasingly popular alcohol breaks like Dry January are buoying the emerging US cannabis market as more drinkers — especially younger ones — see marijuana as a healthier alternative.

Emboldened by widening legalization in the US, cannabis sellers now actively market to January abstainers with new products and targeted advertisement, while research shows about a third of Americans under the age of 25 doing the start-of-year detox use the drug. Weed sales also grow more in January in some legalized states than other months.

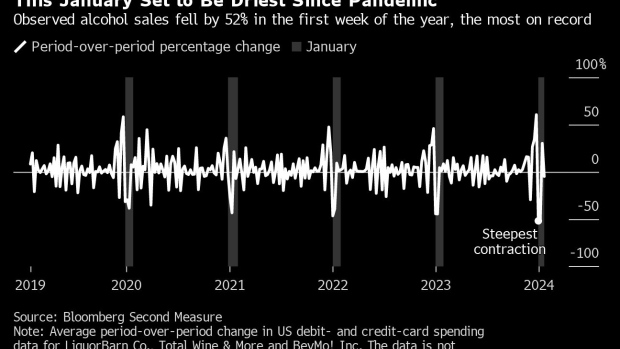

Conversely, alcohol sales fall in January, and tend to drop in places that legalize cannabis. Observed sales hit a post-pandemic low this month at three of the largest US liquor chains, according to data from Bloomberg Second Measure, which tracked a subset of US credit and debit card transactions for LiquorBarn Co., Total Wine & More and BevMo! Inc.

“Anecdotally, we have a lot of people coming into our dispensaries that are saying they are not drinking for January and therefore they’re now upping their cannabis purchases,” said Matt Darin, chief executive officer of Curaleaf Holdings Inc., the most valuable publicly listed marijuana company.

Web searches for Dry January reached an all time high in the first week of the year, doubling from more than a year ago, according to Google Trends data.

Interest has grown yearly since 2016 alongside a growing aversion to alcohol among younger Americans. About half of 18- to 25-year-olds responding to a national survey said they drank in the past month, down from 60% in 2015. Proponents of drinking breaks claim health benefits ranging from better sleep and clearer skin to improved heart and liver function.

It may spell tough times ahead for the liquor industry, especially as more US states look to legalize recreational cannabis. Currently 24 states and Washington D.C. allow it, and at least Florida and Hawaii could see votes this year.

“There’s a lot of cannabis consumers who needed the government to tell them it was OK to use cannabis,” Blair MacNeil, Tilray Brands Inc.’s president of Canadian operations, said in an interview.

Lighting Up

Revenues at Curaleaf, Green Thumb Industries Inc., Verano Holdings Corp., Tilray and Canopy Growth Corp. are set to grow about 6% on average in the first quarter. At the state level, Oregon’s cannabis sales have jumped 19% on average in January since 2018 versus 12% on average in other months. In Colorado, cannabis sales grow the fastest in January on average.

Meanwhile, beer volumes have fallen about 2.6% annually since Canada legalized recreational use in 2018, according to a report by Vivien Azer, TD Cowen’s former managing director of cannabis.

In North America, beer sales are expected to have fallen in the last quarter of 2023 for the first time since the pandemic forced bars and restaurants to close. The drop of 1.7% across Molson Coors Beverage Co., Constellation Brands Inc.’s beer segment, Boston Beer Company and Anheuser-Busch Inbev SA’s North America business would cut about $150 million in revenue.

Still, US alcohol sales aren’t likely to face the same pressure as Canada’s anytime soon as federal legalization of cannabis remains elusive. The drug is currently on par with heroin in US law, though health officials have recommended loosening its restrictions, which some see as a meaningful step toward national legalization.

That reclassification could come as soon as April if Democrats seek to appeal to younger “pro-cannabis” voters ahead of the 2024 presidential election, Curaleaf Chairman Boris Jordan said in a Bloomberg Radio interview.

“Cannabis has a hundred years of stigma that I think is crumbling as we speak,” Curaleaf CEO Darin said.

Edible products — sales of which spike in January — are seen by the industry as a the best way to tackle that stigma. Tilray’s edible sales jump in January, MacNeil said. They’re similarly growing in both dollar terms and unit sales at Verano, President Darren Weiss said in an interview.

“It’s the one category where we see the greatest overlap between folks who are moving away from alcohol or supplanting cannabis use for alcohol consumption,” Weiss said.

The growing perception of cannabis as less harmful than alcohol among younger generations stems in part from marijuana’s more than 30-year-old medical usage in the US to treat disorders including chronic pain, anxiety and anorexia. Issues with addiction and mental disorders like psychosis remain, especially from overuse of high potency products.

For people wary of those risks, or just wanting a drug-free January, non-alcoholic spirits are also growing in popularity.

“January is kind of like the World Cup for us,” Marcus Sakey, co-founder of Ritual Zero Proof, said in an interview. “Every January we see tends to be our biggest month ever ... and that’s what we are expecting this year as well.”

The brand is selling about three bottles of its zero-proof spirits per minute this month, double what it did last January, and expects to be in about 1,000 Walmart Inc. stores later this year. Diageo Plc., the world’s largest alcohol producer by market value, bought a minority stake in 2020.

White Claw-maker Mark Anthony Brewing is the latest liquor giant to make a zero-alcohol version of its drink, following competitors like Corona-owner Constellation Brands and Heineken NV.

©2024 Bloomberg L.P.