Oct 13, 2023

Weight-Loss Drug Frenzy Cements Novo Nordisk as Europe’s Most Valuable Company

, Bloomberg News

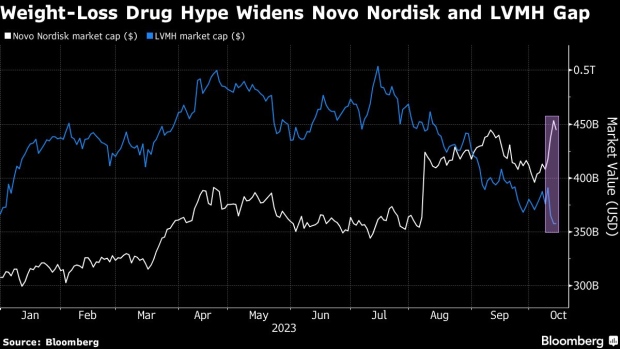

(Bloomberg) -- Little more than a month since becoming Europe’s most valuable listed company, Novo Nordisk A/S has stretched its lead to more than $100 billion as the buzz around weight-loss drugs gets ever louder.

The Danish pharmaceutical maker overtook LVMH at the beginning of September, and since then has accelerated clear as its rising share price has coincided with a slump in luxury stocks. On Friday, Novo hiked its sales and operating profit forecasts for 2023, sending its shares as much as 4.5% higher.

The stock has gained 13% in the last four days, taking Novo’s market value to the equivalent of about $460 billion, far ahead of LVMH’s $355 billion. That’s less than six months after LVMH surpassed $500 billion, becoming the first European company to do so.

While Novo has been boosted by market enthusiasm for its Ozempic and Wegovy injectables, drugs known as GLP-1s, LVMH has struggled amid worries over a slower recovery in the all-important Chinese market. Novo shares have rallied more than 50% this year, while LVMH has fully erased its 2023 gains after this week posting slower sales growth as a post-pandemic boom in high-end goods fizzles.

Neil Campling, founding partner at Chameleon Global, said the diverging fortunes of the two companies partly reflects positioning, given the luxury sector’s popularity with fund managers.

“LVMH and luxury were the most overweight European sector at the start of the third quarter despite signs of consumer woe squeezing all across the landscape,” Campling said in written comments.

While Novo and peer Eli Lilly & Co.’s pipeline of drugs to treat obesity is shaking up sectors from kidney dialysis to snack makers and retailers, Campling sounded a note of caution given worries over pricing and supply glitches.

“GLP-1 is driving healthcare investment volatility like it is the new AI,” he said. “With that comes risk and high expectations, ones that will need to be kept in check over the longer term.”

--With assistance from Jonas Ekblom.

(Adds Novo raising sales outlook, updates shares and market value.)

©2023 Bloomberg L.P.