May 3, 2023

What Wall Street Is Saying About the Fed Rate Decision

, Bloomberg News

(Bloomberg) -- Wall Street was stumped by the Federal Reserve on Wednesday.

In the statement accompanying its quarter-point interest rate hike, the central bank removed prior language that said “some additional policy firming” may be warranted. Then Chair Jerome Powell said that banking-sector conditions have “broadly improved” since early March.

But investors were still left with many questions. Despite Fed staff projections for a mild recession, Powell said that he expects the US economy to grow at a modest pace this year. And while he said that rates were “possibly at” a sufficiently restrictive level, it won’t be “a smooth process” to get back to the 2% inflation target.

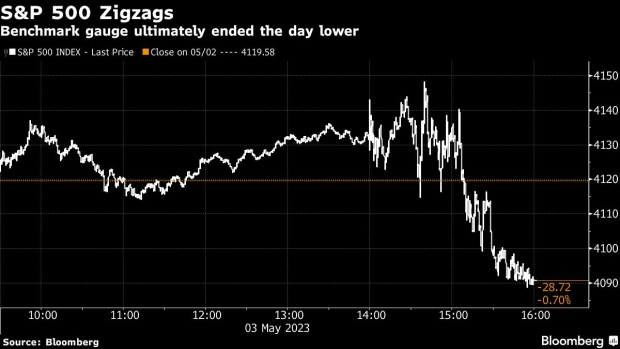

The S&P 500 alternated between gains and losses as Powell spoke before closing down 0.7%. Treasury yields fell. Fed fund futures showed that the chance of a rate hike in June dropped to roughly 2%.

“The fact the stock market is having trouble trying to figure out where to go from here is an indication this was already priced in,” Scott Ladner, chief investment officer at Horizon Investments, said by phone. “Now going forward, investors want to know how much weight the Fed will put on tightening credit conditions that is emanating from regional bank stresses.”

“For us, this is the end of the hiking cycle,” he said. “It would take some pretty disastrous inflation numbers for the Fed to hike again in June.”

Here’s what others on Wall Street had to say:

Jay Woods, chief global strategist at Freedom Capital Markets:

Storm clouds still linger, Powell gave us what we expected, but he didn’t really give investors the language that said everything is clear and smooth sailing ahead. The regional banking crisis isn’t over. Despite what Powell said, he didn’t give us any guidance as to what the next moves from the Fed will be or an “all clear” signal. He didn’t panic about regional banks, but he didn’t reassure investors either.

Eric Winograd, senior US economist at AllianceBernstein:

To be clear, the Fed still has a tightening bias: They will need confirmation from the data that the stance of monetary policy is sufficiently restrictive. That confirmation will eventually take the form of slower inflation, weaker job growth and/or weaker lending activity from the banking sector. In the meantime they are still talking in terms of possible rate hikes, which they view as more likely than rate cuts for the time being. At least tentatively, however, the Fed believes that they may have done enough to bring inflation back down over time, consistent with the expectations reflected in the dot plot released in March.

Zhiwei Ren, portfolio manager at Penn Mutual Asset Management:

The rate decision meets market expectation — it leans a little on the hawkish side because there is no signal of a pause.

Matt Maley, chief market strategist at Miller Tabak + Co.:

It was interesting that he contradicted what the Fed staff said in the Beige Book, but it was also interesting that he did not say they were wrong

He said what I would have expected when he said a mild recession is possible, but didn’t see a big one. The Fed Chair never admits to a full recession until we’re already in one.

Lindsay Rosner, multi-sector portfolio manager at PGIM Fixed Income:

Our view is for a technical recession, when is the question mark, but likely Q3/Q4. If Powell just laid out the framework they are operating under is one of modest growth, not recession, it would suggest they need to change their course if they see a recession. That is why we believe they will have to cut.

Torsten Slok, chief economist of Apollo Global Management, on Bloomberg TV:

It’s still this incredible laser focus on inflation. And I do think that inflation in round numbers at 5% is still way too high relative to the 2% target. So they’re still looking in the rearview mirror and saying: “We just don’t know quite yet how bad this banking crisis is going to be and we just don’t know, therefore, how much credit conditions are going to tighten.”

Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors:

Despite some arguments for a pause going into this meeting, Chair Powell once again garnered unanimous support for another 25 basis point hike.

Future policy decisions likely won’t be as clear-cut, and the Fed is keeping its options open for now.

Gina Bolvin, president of Bolvin Wealth Management Group:

Evidently Powell thinks the economy is strong enough to continue to tighten. A key takeaway is the vote was unanimous.

Sonia Meskin, head of US macro at BNY Mellon:

[Powell’s] data assessment broadly reflects the view of limited success on inflation/labor market front but more work to be done, either through keeping policy tight for some time or raising rates further if inflation momentum does not broadly abate and if financial conditions allow, through of course he wouldn’t say the latter explicitly.

Whitney Watson, global co-head and co-CIO of fixed income and liquidity solutions at Goldman Sachs Asset Management:

From a tactical perspective, we think market-implied pricing for policy easing later this year has room to unwind further. Structurally, we think higher yields and a world of greater uncertainty create a strong case for investors to restore allocations to high-quality core bonds.

--With assistance from Eric J. Weiner, Norah Mulinda, Edward Harrison, Carly Wanna and Vildana Hajric.

©2023 Bloomberg L.P.