Jul 23, 2019

When an iPhone 3-D Sensing Firm Asks for Blind Faith

, Bloomberg News

(Bloomberg Opinion) -- Today should be a good news day for AMS AG, the Austrian maker of key components for the facial recognition system in Apple Inc.’s iPhone.

It seems finally to be delivering on its repeated promise that a multi-year, $2 billion investment in 3-D sensing technology would ultimately pay off. It forecast third-quarter revenue of between $600 million and $640 million, well above analysts’ $526 million average estimate.

Yet the good news came with a sting in the tail. Chief Executive Officer Alexander Everke said AMS was again evaluating the possibility of a bid for Osram Licht AG, after being approached by unidentified “potential financial partners.” The revelation comes just a week after AMS decided not to pursue an offer for the Munich-based lighting maker, which had already agreed a sale to private equity firms Bain Capital and Carlyle Group LP. That climbdown from AMS in turn came after re-entering talks it had previously abandoned, and… well you get the idea. It’s flip-flopping in the extreme.

Maybe Everke has made the right calls technologically. AMS’s initial struggles stemmed from the disappointing sales of Apple’s iPhone X range of handsets. Now Android handset-makers are following up with more 3-D sensors, boosting orders for AMS’s gear. Operating cash flow and order backlogs are on the increase.

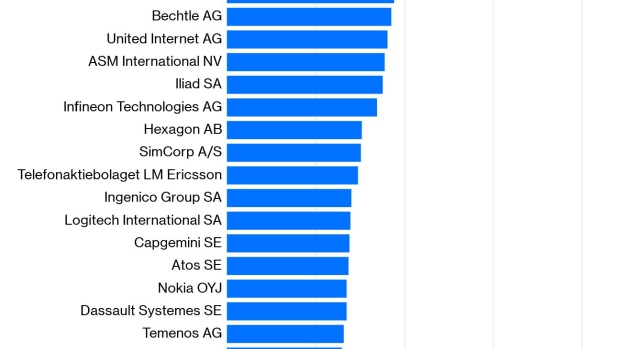

But Everke does himself few favors. The former NXP Semiconductors NV executive has made AMS an extremely tough investment case: the stock has consistently had the highest 120-day volatility of any European tech firm over the past three years. The Osram affair is a prime example of the behavior causing this.

As a conference call on Tuesday progressed, AMS shares pared earlier gains of as much as 10%. Analysts repeatedly tried and failed to get clarity from Everke and his team on the logic behind any Osram bid, and investor faith in his strategy appeared to wane by the minute. Executives repeatedly parroted a line about any bid target needing to meet AMS’s acquisition criteria, without giving any sense as to whether or how Osram met them. By the time the call ended, the stock was trading just 1.9% higher than Monday’s close.

I wrote last week how any bid would require a serious leap of faith from investors. Perhaps he thought that the upswing in earnings would help warrant such trust. But given the failure to explain why any deal for Osram might make sense, the leap he’s asking for is a blind one. Investors have been burned enough before to be wary about taking it.

To contact the author of this story: Alex Webb at awebb25@bloomberg.net

To contact the editor responsible for this story: Jennifer Ryan at jryan13@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Alex Webb is a Bloomberg Opinion columnist covering Europe's technology, media and communications industries. He previously covered Apple and other technology companies for Bloomberg News in San Francisco.

©2019 Bloomberg L.P.