Oct 14, 2020

Where to Find Investment Income Now That Bank Dividends Are Drying Up

, Bloomberg News

(Bloomberg) -- The worst year for stock dividends in over a decade is upending formerly rock-solid retirement plans all across Asia.

Nearly a third (28%) of Asia Pacific companies — including marquee names like HSBC Holdings Plc, Westpac Banking Corp. and Nissan Motor Co. — have scrapped or reduced dividends this year as the coronavirus pandemic forced them to conserve cash. That’s considerably greater than the 13% in the U.S. though still behind the 50% in Europe, according to data compiled by Bloomberg.

Contrary to the stereotype of growth-stock chasing Asian investors, many in markets like Australia, Singapore and Hong Kong are actually more reliant on yields than their global counterparts. Unlike places like the U.K., annuities are uncommon in the region. That makes company dividends a key income source alongside things like rent from investment properties.

Retired Australian school teacher Kerrie Bible, 68, is one of the many feeling the pinch.

When she stopped work eight years ago, you could still get a return of nearly 5% just on cash in the bank. Now it’s a stretch to get near to 1%. Her biggest holding, Westpac, like the rest of the Australian banking sector, was long renowned for a steady stream of payouts that continued throughout the global financial crisis and reputational woes.

Then Covid-19 hit.

The Sydney-based bank was among the 444 companies across the region to lower or outright cancel dividend payments this year, according to data compiled by Bloomberg through Oct. 9. That’s the most since 2009 when more than 490 held back on payouts -- and higher than in any other region.

Firms listed in China and Hong Kong make up a majority of those scrapping dividends, along with companies in Japan and Australia. And the expectation is that the pain will continue next year.

Bible’s overall portfolio is now down “hundreds of thousands” of dollars as Australian bank stocks languish about 26% below last year’s levels.

“We need the money, we need the dividends to keep on living reasonably well,” Bible said, noting while she has savings, the dividend cuts have forced her to give up on the little luxuries like new clothes or eating out she planned carefully for.

Though she’s as far from the stereotype of the Robinhood generation that’s been driving a flood into growth stocks as you can get, confronted with declines in her income, Bible said she’s now investing more in tech stocks that don’t usually pay big dividends but have jumped like local software developer Altium Ltd.

“What we’ve had to do is to increase our risk,” she said.

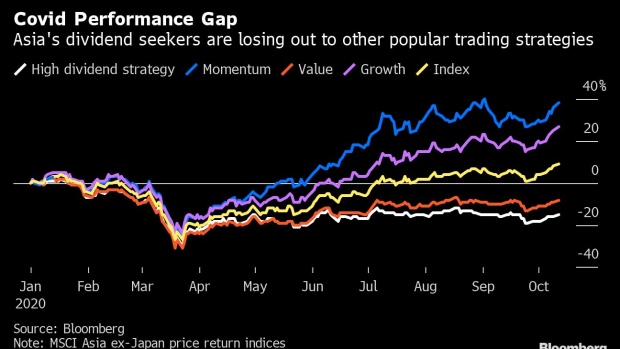

Already surging before Covid-19 hit, the tech sector has been even more supercharged this year by remote working and a flood of easy money from central banks. In fact, portfolios based on a high dividend investment strategy have lost 21% so far this year in the region, compared with a 26% gain for momentum investors, according to Bloomberg data.

Some of Bible’s friends are taking even bigger risks, she says, putting money into products that provide bridging finance for real estate developers who haven’t yet managed to sell units and can’t get finance from the banks.

Australians aren’t the only ones disgruntled in Asia.

Paul Chan, a Hong Kong-based business consultant in his 40s, is among the retail investors that make up a third of HSBC’s stock and dumped his shares soon after Europe’s largest lender said it would halt payouts in March. He had just bought into HSBC last year and is now considering branching into tech stocks.

“I used to think that dividends were a source of continued passive income,” Chan said. “HSBC’s scrapping of dividends made me realize that no payouts by anyone are guaranteed.”

He’s continued to hold Chinese lenders like Bank of China Ltd., which like the other big lenders in the country have actually maintained their dividend payout ratios this year, and his overall is plan is to get “more aggressive” with his portfolio.

It’s hard to overstate the frustration in Hong Kong with HSBC’s decision to scrap dividends this year for the first time ever. The London-based bank is part of the city’s fabric: Founded in Hong Kong 155 years ago, HSBC makes the bulk of its profit from the city, and had relied on investors to buy up a rights offering during the global financial crisis. It had long been the stock parents handed down to their children graduating from college or getting married.

When HSBC axed its payout, “it broke the myth of sustainable dividends,” Edmond Hui, CEO of Bright Smart Securities in Hong Kong said, noting that his clients are now amping up their exposure beyond bank shares. Historically, only about 30% of his clients held tech or new economy stocks, now its about 60%, Hui said.

Before throwing in the towel to chase the tech boom though, and risk buying into overvalued stocks without steady income streams, the professionals say there are still income shares out there. Singapore’s REITS, with dividend yields of more than 4%, remain hot for funds, and not just the city’s pensioners. There are other options out there.

Here’s where to look for dividends:

Taiwan technology stocks: You can find attractive companies that are tapping into strong demand from 5G, data centers, and next generation smart phone markets. At the same time, they would have consistent dividend policies and strong operation cash flows to support sustainable dividends - David Han, portfolio manager of Principal Global Investors’ Asia Pacific High Dividend Equity Fund

Covid beneficiaries: Look to new emerging cashflow-rich sectors that may return excess cash to investors more regularly going forward. For the latter, we like gloves over tech - while both are growth sectors, we favor gloves as a new yield sector given the combination of surging free cashflow and low PEs, which translates into high dividend yield percentages - Anand Pathmakanthan, Head of Regional Equity Research at Maybank Kim Eng Group

Read more: The Gloves Kingdom Has Been Minting New Billionaires

Physical infrastructure: There are still plenty of opportunities for dividends in Asia in telecommunication companies, listed infrastructure assets, REITS and materials - Sat Duhra, a fund manager of Asian dividend income strategy at Janus Henderson Investors in Singapore

China factor: Investors struggling to find yields should look to China, with the highest yields in the energy and real estate sectors within the China A-share universe. By the end of 2019, 75% of China’s top 800 A-share companies paid dividends; in 2009, just 57% did. “Many investors are surprised to learn that because they assume domestic Chinese companies are less attentive to shareholder returns; however, corporate governance in China is improving,” - Sarah Lien, portfolio manager of Eastspring Investments in Singapore

©2020 Bloomberg L.P.