Oct 10, 2023

World Is Dominated by Junk Government Bonds After US Downgrade

, Bloomberg News

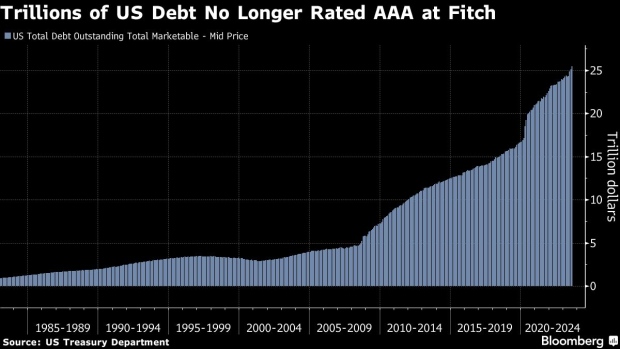

(Bloomberg) -- The global government bond market has hit a turning point: junk-rated debt now exceeds top-rated debt for the first time, following Fitch Ratings’ August move to strip the US off its AAA credit grade.

Fitch’s downgrade of the $33 trillion US debt to AA+ means only $5 trillion of government debt globally is still rated AAA, leaving it as a smaller group than sub-investment-grade debt, the rating company said in a statement. The share of top-rated government bonds have fallen to just 6% of total debt outstanding, from more than 40%.

“‘AAA’ had previously always been the largest sovereign rating category, measured by outstanding debt, notwithstanding the fall in the number of ‘AAA’ rated sovereigns since the eurozone crisis,” Fitch said in a statement Tuesday.

Australia, Germany, Singapore and Switzerland are among a handful of countries that still enjoy the AAA rating at Fitch.

--With assistance from Liz Capo McCormick and Michael Mackenzie.

©2023 Bloomberg L.P.