Nov 8, 2023

World’s Most Expensive City to Face First Rental Slump in Four Years

, Bloomberg News

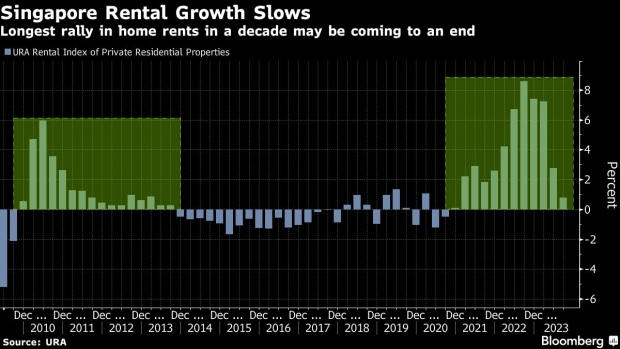

(Bloomberg) -- The longest rally in Singapore’s housing rents in a decade may be coming to an end.

The city-state’s residential rents may decline as much as 10% in 2024 after rising up to 15% this year, Bloomberg Intelligence analyst Ken Foong said in a report Wednesday. He said the drop may be even greater if the macro-economy worsens or a crisis emerges.

Twice as many new homes were built in 2023 compared with the previous year as construction bottlenecks eased after the pandemic, he wrote. Running down this supply will take time, as it’s above the annual average in the 10 years before. More new homes coming onto the market next year will also suppress rents.

“Tenants are likely to push back on sky-high rents due to higher vacancy, with more units to choose from, macro uncertainties and the rising cost of living,” Foong said.

High rents, a pain point for Singapore expats and locals alike, are already easing. The government’s index for private housing leasing costs gained just 0.8% in the third quarter, the slowest increase since rents started climbing at the end of 2020.

The expected drop would give some relief to tenants hit by increasing costs in what’s become the world’s most expensive city for luxury living. Leasing costs surged 30% last year, the most in 15 years as Singapore became one of the first countries in Asia to reopen its borders during the pandemic, driving its attractiveness to the rich.

The number of vacant homes has also risen to 34,341 units in the third quarter, outpacing the average of 27,000 between 2014 and 2017, when rents fell for four straight years, the longest stretch of annual declines since the end of the last century, government data show.

While rents overall are expected to fall, some landlords may still increase prices on expiring leases that were entered two or three years ago, though at a lower rate, Foong added.

©2023 Bloomberg L.P.