Feb 29, 2024

Xcel Drops as Law Firm Says Utility May Have Texas Fire Link

, Bloomberg News

(Bloomberg) -- The worst-ever Texas wildfire sent shares of Xcel Energy Inc. plunging after a law firm said it might be linked to the disaster, the latest sign that potential ties between power companies and blazes are triggering volatility in once-sleepy utility stocks.

The unnamed firm said Xcel may be responsible for damages and asked the company to preserve as evidence a fallen utility pole located near the fire’s potential area of origin, Xcel said in a regulatory filing Thursday. The company’s shares fell as much as 9.7%, the most since March 2020 — a drop that reflects concern about potentially “catastrophic” wildfire liabilities, Bloomberg Intelligence analyst Nikki Hsu said in a note to clients.

“We will cooperate with officials while conducting our own investigations to determine the causes of the fires,” an Xcel spokesperson said in an emailed statement. The company serves about 3.7 million electricity customers across a broad swath of the US, from Minnesota to New Mexico.

America’s power companies are facing increasing pressure to gird their systems against the growing threat of wild weather spurred by climate change. California utility PG&E Corp. was driven into bankruptcy in 2019 after its equipment sparked some of the worst fires in state history. Hawaiian Electric Industries Inc. is the target of several lawsuits blaming the Maui fire of 2023 on the company’s power lines.

Xcel already faces lawsuits that accuse one of the company’s utilities of sparking the most destructive fire in Colorado history, which state officials concluded was caused in part by a power line that snapped during high winds. The company disputes that its equipment caused the Colorado ignition. The December 2021 blaze, known as the Marshall Fire, destroyed or damaged more than 1,000 structures and caused an estimated $2 billion in property losses.

Global warming and worsening wildfires have left utilities increasingly vulnerable to lawsuits and financial liability when their infrastructure sparks destructive blazes, said Gerald Singleton, a managing partner at law firm Singleton Schreiber, which is representing dozens of Marshall fire victims.

“It has introduced a level of risk for utilities that wasn’t there before,” he said.

The Smokehouse Creek Fire is the largest-ever Texas wildfire, having charred more than 1 million acres along the state’s panhandle. At least one person died due to the blaze — an octogenarian who was trapped in her home, according to multiple media reports. Tens of thousands of cattle already may have perished and entire ranches have been wiped out, said Texas Agriculture Commissioner Sid Miller.

Read More: Worst Texas Wildfire in History Imperils Thousands of Cattle

“Anytime you talk about utilities, wildfires and potential litigation, the initial reaction is going to be one of fear,” said Paul Patterson, a utility analyst for Glenrock Associates LLC. “Investors are potentially skittish about wildfires.”

Thursday’s stock drop, which erased about $1.9 billion of Xcel’s market cap, is “an overreaction, albeit understandable given the overall anxiety around wildfire-specific risk among investors,” Sophie Karp, a utility analyst for KeyBanc Capital Markets, said in a note to clients.

Karp, who has an “overweight” rating on the stock, added that no determination of the wildfire cause has been made, it is burning in a sparsely populated area and Xcel has about $500 million in insurance.

Read More: Maui Fire Lays Bare Utility Missteps Mirrored Across the Country

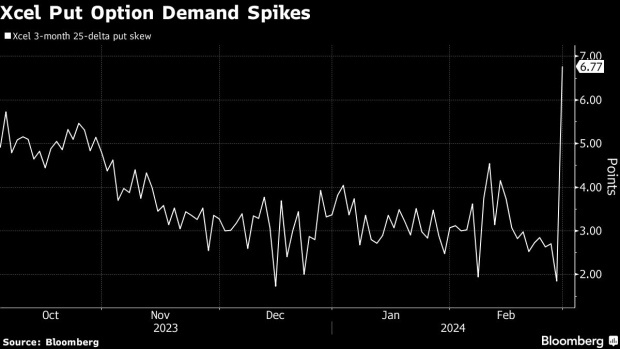

Still, investors piled in to the Xcel options market for protection, pushing volume to almost 16,000 contracts — more than 30 times average — nearly all of them puts betting that the stock has further to fall. Puts expiring in September were the most actively traded, allowing the holders to sell more than 400,000 shares at $45. The cost of puts increased almost five times as much as calls, signaling the demand for cover against a slide in prices.

--With assistance from Carly Wanna and David Marino.

(Story updates with background starting in third paragraph)

©2024 Bloomberg L.P.