Jul 12, 2022

Yellen Agrees With Japan’s Suzuki on Volatile Forex Risk

, Bloomberg News

(Bloomberg) -- US Treasury Secretary Janet Yellen agreed with her Japanese counterpart Tuesday that volatile exchange rates pose a risk, and pledged to consult and cooperate as appropriate.

“The economic fallout from Russia’s invasion has raised exchange rate volatility, which can have adverse implications for economic and financial stability,” Yellen and Finance Minister Shunichi Suzuki said in a joint statement after meeting in Tokyo. “We will continue to consult closely on exchange markets and cooperate as appropriate on currency issues, in line with our G-7 and G20 commitments.”

Yellen and Suzuki also welcomed last month’s statement from G-7 leaders promising to explore a potential price cap on Russian oil exports. The US Treasury chief has championed the idea as a way to keep oil flowing to global markets while limiting the revenue the Kremlin gets to continue pursuing its Ukraine invasion.

Read More: Yellen Heads to Asia With Russia Oil-Price-Cap Top of Mission

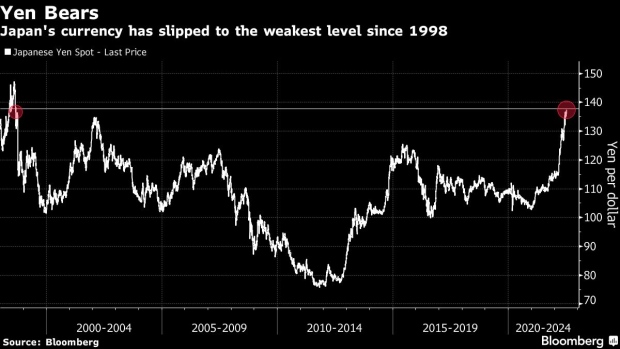

The duo met after the yen tumbled overnight to its weakest against the dollar since 1998. Japan’s government has expressed concern about the slide, which has made energy imports all the more expensive and undermined Japanese households’ purchasing power.

The yen’s fall has stoked speculation that Japan could intervene to prop up its currency, perhaps in concert with the US. The last time the two nations intervened jointly to support the yen was in 1998.

Suzuki said earlier in the day that he was monitoring foreign exchange markets with a strong sense of urgency, sticking close to the language of previous warnings that suggest Japan is still a ways from trying to directly take action.

Read More: Traders See Three New Catalysts Forcing Yen Past 140 Per Dollar

Market participants argue such a move would have little lasting effect now given sharply divergent American and Japanese monetary policies. While the Federal Reserve is in the midst of conducting its most aggressive series of interest-rate hikes in decades, the Bank of Japan has stood pat, with its target of near-zero yields for 10-year government bonds unchanged.

A senior US Treasury official, speaking with reporters in Tokyo, noted that while prior G-20 agreements commit members to respect market-based exchange rates, the language also allows for countries to address “excessive volatility or disorderly movements” that can negatively affect economies and financial stability.

The official emphasized, however, that Tuesday’s joint US-Japan statement doesn’t say that Japan currently faces excessive volatility or disorderly movements. Nor is the statement an acknowledgment by Yellen that Tokyo would be justified in intervening in currency markets. It only states that the two countries will continue to monitor and discuss exchange rates, the official said.

Read More: There’s Big Trouble With Trade Balances

Japan and other nations reliant on foreign energy imports have seen their trade balances deteriorate since Russia’s invasion of Ukraine -- one reason their exchange rates are sliding. The euro has dropped toward parity against the dollar, a level unseen since 2002.

Yellen has made building support for a price cap on Russian oil a centerpiece of her first trip to Asia as Treasury secretary, and plans to discuss the plan at multiple meetings in coming days. After Tokyo, she heads to Bali, Indonesia, for a gathering of finance ministers from Group of 20 nations. She ends her trip with a Seoul stop.

“We welcome G-7 efforts to continue exploring ways to curb rising energy prices, including the feasibility of price caps where appropriate, while considering mitigation mechanisms to ensure that most vulnerable and impacted countries maintain access to energy market,” Yellen and Suzuki said in the statement.

The aim is to ban, by the end of this year, the insurance and transport services needed to ship Russian crude and petroleum products unless the oil is purchased below an agreed price.

Treasury officials say securing the cap will be crucial for preventing the price of oil from reaching around $140 a barrel. Prices, which rose above $120 a barrel in June, currently sit at around $103 a barrel.

Read More: Treasury Says Russian Oil Price Cap Key to Avoid New Cost Shock

The Biden administration is keen to increase the economic pain for Moscow over its invasion of Ukraine in February. The US and its allies have already imposed punishing sanctions, but with oil and gas prices rising since the war began, Russia has seen revenue for energy exports increase dramatically, helping offset the damage.

Japan, which has substantial imports of Russian energy, has so far not backed the plan. The Treasury official said Tokyo is likely looking for reassurance that the price cap would not be set too low, thereby removing Russia’s incentive entirely to continue with exports.

©2022 Bloomberg L.P.