Dec 18, 2022

Yen Jumps on Report of Kishida Flexibility on Monetary Policy

, Bloomberg News

(Bloomberg) -- The yen whipsawed in Monday trade after reports on a potential change to a key agreement between the government and central bank fueled speculation policy makers are moving closer to a hawkish pivot.

Japan’s currency jumped as much as 0.6% after Kyodo said on Saturday that Prime Minister Fumio Kishida may seek to revise a decade-old accord with the Bank of Japan and consider adding flexibility to the 2% inflation goal, potentially paving the way for an end to its ultra-dovish policy. The yen pared gains after a top government spokesman denied the report.

The existing agreement commits the government and the BOJ to achieving its 2% inflation goal as early as possible.

The BOJ has long since missed Kuroda’s original time line of around two years. Still, removal of the phrase would go a step further in recognizing that achieving stable inflation is a longer term goal while implying that factors other than time also need to be considered.

The latest report around Kishida adds to speculation about a potential policy change at the BOJ after Governor Haruhiko Kuroda steps down in April. The development comes after an aide to Kishida told Bloomberg earlier this month there was a possibility of reaching a new accord with the central bank.

Chief Cabinet Secretary Hirokazu Matsuno said there were no plans to revise the accord with the BOJ, and he hoped the central bank would continue to work toward the inflation target. The BOJ is forecast to keep settings on hold at a policy meeting Tuesday.

“The weekend news highlights a clear level of uneasiness by the government in terms of the degree of depreciation the yen has endured this year,” said Rodrigo Catril, a currency strategist at National Australia Bank in Sydney. “Next year offers an opportunity to reset and as has been alluded allow for a more flexible approach on BOJ objectives.”

Worst Performer

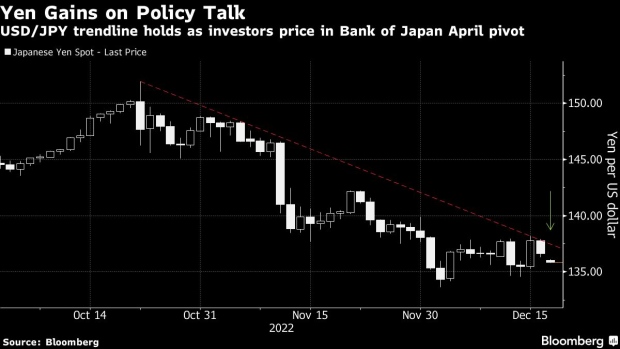

The yen has been the worst-performing major currency this year, sliding more than 15% versus the dollar, as Kuroda’s insistence on buying massive amounts of government bonds meant Japan’s yields have been capped, while they soared elsewhere in the world as most central banks raised interest rates to combat inflation.

The yen was 0.5% stronger Monday at 135.99 per dollar after earlier advancing to 135.76. The currency tumbled to more than a three-decade low of 151.95 in October.

The yield on Japan’s benchmark five-year bond rose 2.5 basis points to 0.145% in early Monday trade to reach the highest level since February 2015.

Expectations are growing among investors and economists that Kuroda’s successor will call for a review of policy some time after taking the helm of the central bank.

Last week Bloomberg reported that Bank of Japan officials saw the possibility of a policy review next year, after wages growth and any slowdown in the global economy are closely examined, according to people familiar with the matter.

The Kyodo report “spurred yen buying because the BOJ meeting is drawing near and the relatively hawkish monetary policy decisions in the US and Europe last week had emphasized the contrast with the BOJ’s dovish stance,” said Shinsuke Kajita, chief strategist at Resona Holdings Inc. in Tokyo.

--With assistance from Daisuke Sakai, Masaki Kondo and Paul Jackson.

(Updates with additional background)

©2022 Bloomberg L.P.