Aug 21, 2022

Yen Weakness Returns Ahead of Jackson Hole With 140 Back in Play

, Bloomberg News

(Bloomberg) -- The resurgent dollar is threatening to snuff out the nascent rally in the yen, just as speculators had given up on betting against the Japanese currency.

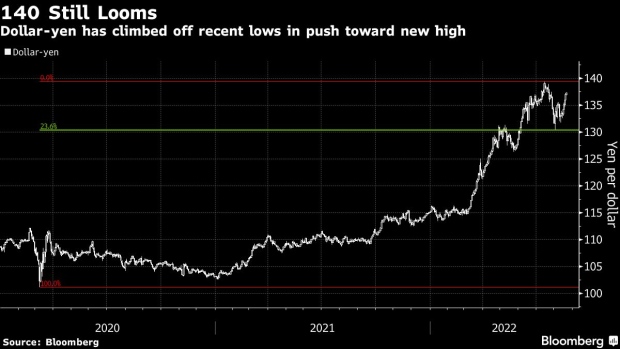

The greenback jumped almost 3% against the yen last week, helped by a spike in Treasury yields as traders readied for hawkish Federal Reserve commentary at their upcoming Jackson Hole symposium. The strength was broad based as the US currency surged against all Group-of-10 peers, but it has put dollar-yen back on track for a push toward the closely-watched 140 level.

Renewed strength in the greenback comes just as currency traders were leaning toward the view that the worst of this year’s losses for the yen were behind it. The currency had been pummeled by a widening US-Japan interest-rate gap, soaring oil prices and a weakening of its haven status but mounted a recovery from mid-July as hedge funds covered short positions.

Leveraged investors have slashed their net-bearish yen wagers to the least since March 2021, according to the latest data from the Commodity Futures Trading Commission.

While further strength in the greenback could reignite what had been one of the hottest macro trades of the year, for now yen watchers see any retreat as temporary. But a push past 140 per dollar would renew pressure on the Bank of Japan over its super-easy monetary policy and on the government to intervene.

“The dollar-yen may approach the year-high 139.39 as markets price in a hawkish Powell speech,” wrote Masafumi Yamamoto, chief currency strategist at Mizuho Securities in Tokyo, in a note Monday. “But given that the dollar appears to be rising faster in light of US yields, the pair may also be prone to fall after his speech as markets have factored in the hawkishness.”

Dollar-yen traded around 136.90 in Europe on Monday, down slightly on the day as investors took a pause from last week’s rally.

Fed Chair Jerome Powell is expected to reiterate the central bank’s resolve to keep raising rates to contain inflation in his speech Friday, snuffing out speculation for a rate cut next year.

“The dollar may be supported leading up to Jackson Hole on expectations for a hawkish Fed with the range for dollar-yen seen between 134 and 139,” said Shinsuke Kajita, chief strategist at Resona Holdings in Tokyo. “But the pair may become top-heavy as the dollar’s appreciation also has a risk-aversion element which could be reflected in yen strength.”

(Updates levels.)

©2022 Bloomberg L.P.