Jun 17, 2021

Yield on 30-Year Treasuries Tumbles as Curve Continues to Flatten

, Bloomberg News

(Bloomberg) -- Long-term Treasury yields spiraled lower a day after the Federal Reserve pulled forward its signal for when monetary policy tightening may start, helping dim risk that inflation expectations could become unmoored.

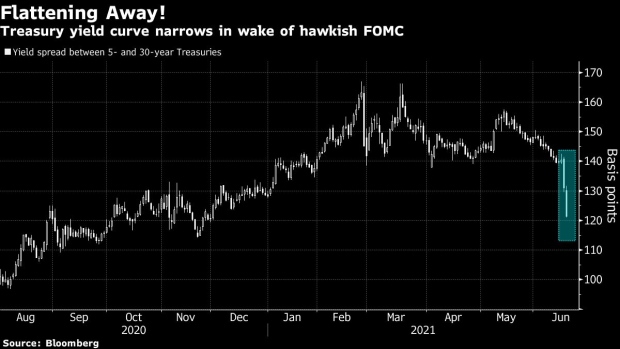

The 30-year bond yield fell to 2.07% Thursday, its lowest since Feb. 19. The drop in long-end yields comes as the central bank penciling in two rate hikes by the end of 2023 has reined in prices of shorter-term debt. That drove the yield curve, as measured by the gap between 5- and 30-year debt yields to its least since November, at about 119 basis points.

The net results of the Fed’s actions Wednesday should “be sufficient to tilt the bias of intermediate versus longer-term yield curves toward flattening on better-than-expected data,” Praveen Korapaty, chief rates strategist at Goldman Sachs Group Inc., wrote in note with his colleagues.

©2021 Bloomberg L.P.