Sep 22, 2019

Yuan Gains, Yen Slips as Trade Talks Progress: Markets Wrap

, Bloomberg News

(Bloomberg) -- The yuan climbed as investors monitored signs of progress in trade discussions with the U.S. The yen edged lower and stock futures pointed to a mixed start in Asia.

China’s Ministry of Commerce said trade groups from the two nations held “constructive” talks on relevant economic and trade issues of mutual concern in Washington last week. Also helping sentiment: China Business News reported that Vice Agriculture Minister Han Jun said his nation’s withdrawal from a planned visit to U.S. farm states had nothing to do with trade talks.

While traders remain on edge due to fragile negotiations on the trade front, markets are pricing increased action from many central banks around the world. Global equities are on course for an advance this month following the Federal Reserve’s second interest-rate cut of 2019.

With Tokyo closed for a holiday, market moves may be exacerbated due to thin liquidity. Cash Treasuries won’t trade until the London open and Japanese equities will be shut.

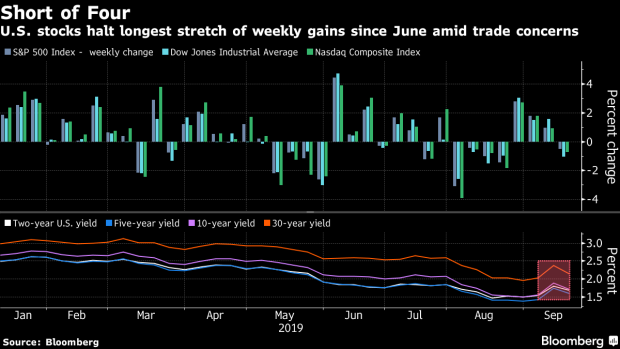

Elsewhere, Friday saw U.S. equities retreat along with Treasury yields. Futures in Hong Kong dipped and contracts on Australian equities were little changed.

These are some key events coming up this week:

- New York Fed President John Williams speaks at the U.S. Treasury Market Conference hosted at his bank Monday. San Francisco Fed President Mary Daly delivers remarks in Salem, Oregon.

- Decisions are due Wednesday from central banks in New Zealand and Thailand. Thursday brings a monetary policy decision in Philippines.

- Core PCE -- the Fed’s preferred inflation measure -- is forecast for 1.8%, the strongest reading since January. That’s due Friday.

Here are the main moves in markets:

Stocks

- The S&P 500 Index fell 0.5%.

- Hang Seng futures slid 0.4%.

- Futures on Australia’s S&P/ASX 200 Index were little changed.

Currencies

- The yen fell 0.2% to 107.72 per dollar.

- The offshore yuan rose 0.3% to 7.1043 per dollar.

- The euro bought $1.1018.

- The British pound was steady at $1.2476.

Bonds

- The yield on 10-year Treasuries fell six basis points to 1.72% on Friday.

Commodities

- Gold rose 1.2% to $1,516.90 an ounce on Friday, when West Texas Intermediate crude fell 0.2% to $58.09 a barrel.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Linus Chua, Virginia Van Natta

©2019 Bloomberg L.P.