Nov 11, 2022

Yuan Swings Like Never Before as Reopen Hopes Eclipse Xi Concern

, Bloomberg News

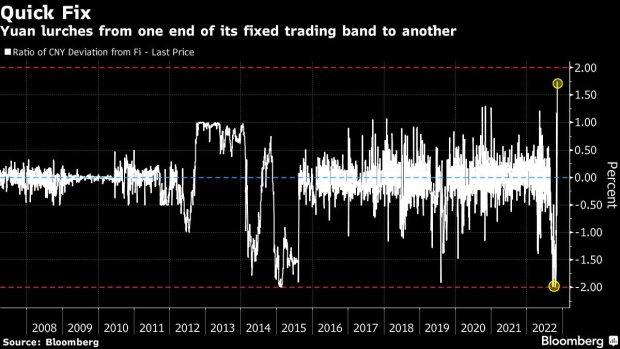

(Bloomberg) -- The yuan has swung violently from one end of its tightly-managed trading band to the other like never before, as optimism toward a pivot from Covid-Zero evaporated concern about President Xi Jinping’s consolidation of power.

The onshore yuan rallied some 1.6% after health officials confirmed China will reduce the amount of time travelers must spend in quarantine. That’s the closest ever to the stronger end of its trading band -- which is based off the central bank’s daily currency fixing -- since the limit was increased to 2% in 2014.

Just last week the currency was at the other end of the band, as pessimism toward China’s assets reached fever pitch, after a leadership reshuffle giving Xi unchallenged control reignited a debate that the world’s second largest economy was uninvestable.

Pessimism over China’s growth and geopolitical concerns have weighed heavily on the yuan this year, pushing it to weakest since 2007 versus the dollar, before speculation over reopening lured some bulls back in. The yuan’s gain Friday followed a broad selloff in the dollar amid growing bets for a slower path of Federal Reserve rate hikes.

“The cooling US CPI report and confirmation of China’s Covid measures easing is changing the bearish picture for the yuan,” said Ken Cheung, strategist at Mizuho Bank. “The upcoming G-20 talks between Xi and Biden will also offer an opportunity for investors to reassess the outlook for China-US decoupling risk.”

(Adds quote.)

©2022 Bloomberg L.P.