Feb 2, 2023

Zambia Moves to Bolster Currency Hit by Protracted Debt Talks

, Bloomberg News

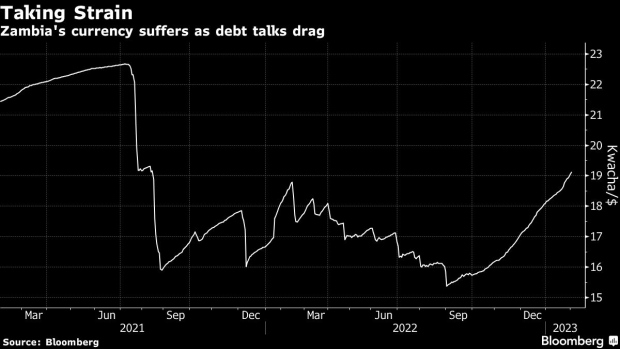

(Bloomberg) -- Zambia’s central bank increased commercial lenders’ reserve ratios to slow a slide in the nation’s currency battered by debt-restructuring talks that have dragged for two years.

The Bank of Zambia increased the reserve ratio on domestic- and foreign-currency deposits to 11.5% from 9%, it said in a circular to lenders dated Feb. 1, which it confirmed to Bloomberg. The increased reserve-ratio requirements are effective Feb. 13.

“This measure is aimed at addressing the increased volatility in the exchange rate, which intensified in December 2022 and has persisted in 2023,” the central bank said. “The trend, if left unaddressed, has the potential to undermine the emerging stable macroeconomic environment.”

Zambia’s kwacha was Africa’s second-best performer in 2021 after President Hakainde Hichilema’s landslide election victory in August that year. He brought a wave of optimism into an economy battling inflation of more than 20% after it became the first on the continent to default in the Covid-19-pandemic era. He’s made major economic gains like bringing consumer price growth back below 10%, but delays to debt restructuring are hitting investor sentiment and the currency, which is back at levels last seen before Hichilema won power.

The kwacha has depreciated by almost 20% since Sept. 1, when news of the finalization of an International Monetary Fund bailout gave the currency a boost. Even then, only about one in two Zambians approved of the country’s overall direction and were satisfied with the way the new government was managing the economy, an Afrobarometer survey showed last week. It conducted the interviews between Aug. 3 and Sept. 7.

US Treasury Secretary Janet Yellen and IMF Managing Director Kristalina Georgieva visited Zambia last week, calling on creditors to move quickly to finalize debt restructuring.

“If not concluded soon, it’s going to distort all the good efforts that we’ve been making to re-construct the economy,” Hichilema told Georgieva in a meeting.

Neighboring Mozambique’s central bank also increased its reserve-ratio requirements for commercial lenders last week. Local currency liability ratios rose to 28% from 10.5%, while foreign currency ratios jumped to 28.5% from 11.5%.

The Banco de Mocambique acted “in order to absorb the excessive liquidity in the banking system, with the potential to generate inflationary pressure,” it said in a Jan. 25 statement.

--With assistance from Matthew Hill.

©2023 Bloomberg L.P.