May 26, 2020

Zloty Zooms Toward Pre-Lockdown Levels as QE Fears Subside

, Bloomberg News

(Bloomberg) --

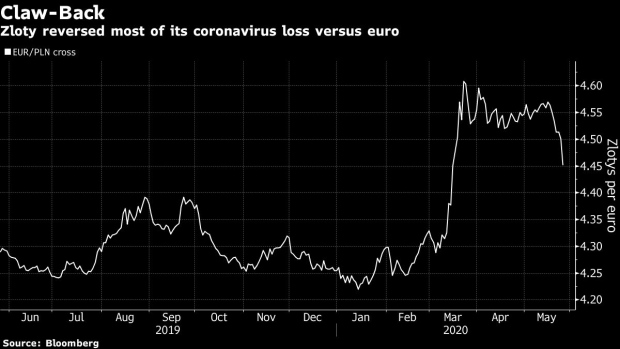

Poland’s zloty, the day’s top performing emerging-market currency, is nearing levels against the euro not seen since the start of the country’s coronavirus lockdown restrictions two months ago.

The turnaround comes as fears over the country’s turbo-charged quantitative easing program subside and the National Bank of Poland, which slashed rates twice in March and April, is seen holding borrowing costs unchanged this week. The move leads Tuesday’s rally in east European currencies after the European Union’s 500 billion euro ($549 billion) relief plan stoked hopes for better economic prospects.

“Markets are now positioning for a more cautious NBP, most likely keeping rates on hold,” Deutsche Bank’s London-based strategist Christian Wietoska said. The central bank “has been aggressive with their response at the beginning, and now they can be on the sideline and act more aggressively again when needed, later in the year,” he said.

The zloty, which jumped 1.1% to 4.4508 per euro, is still “extremely cheap,” according to Wietoska. His models show the euro-zloty pair trading around 4.40, with the divergence from this level mainly due to the central bank’s dovish rhetoric and its massive QE program. The central bank has already bought 71 billion zloty ($17.5 billion) worth of bonds, or twice as much as the Finance Ministry sold at regular debt auctions this year.

The yield on the country’s benchmark 10-year bond rose 1 basis point to 1.41% after the government suspended on Monday its fiscal spending rule which limits state expenditure. The move, flagged by Finance Minister Tadeusz Koscinski in an interview in March, is a prerequisite for the government to amend this year’s budget for the coronavirus fallout.

Despite the gains, the zloty isn’t out of the woods yet, Wietoska said.

“Negative shocks for risky assets seem very likely over the summer,” he said, predicting the zloty near 4.5 per euro over the near-term.

©2020 Bloomberg L.P.