Apr 2, 2024

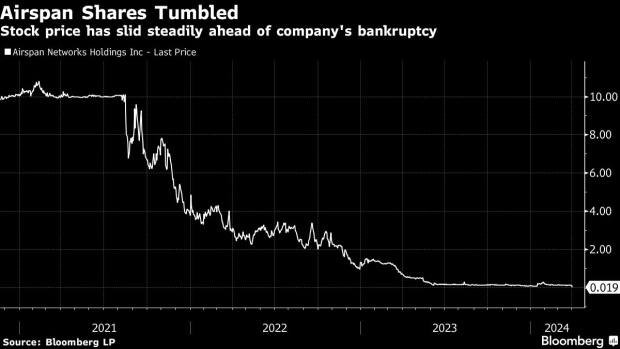

Airspan, Child of Wall Street SPAC Craze, Seeks Quick Bankruptcy

, Bloomberg News

(Bloomberg) -- Airspan Networks Holdings Inc. won court approval to try to cut debt in bankruptcy under a quicker-than-normal schedule, putting it on pace for a swift turnaround after becoming the latest financial collapse from the Wall Street SPAC boom.

The company, which helps clients build private wireless networks, blamed its losses on lingering supply-chain disruptions, competitive pressure and the need to spend heavily on research.

Airspan filed for bankruptcy Sunday with a proposal, backed by Fortress Investment Group, to give lenders ownership in return for canceling debt and raising as much as $95 million in cash to help the company restructure, according to court papers filed in US Bankruptcy Court in Wilmington, Delaware. The company owes lenders about $205 million, according to court documents.

The company won court approval Tuesday to seek a quick vote of creditors in the coming weeks, which is a key step before it can emerge from bankruptcy. US Bankruptcy Judge Thomas Horan scheduled a hearing for May 8 to consider giving Airspan final approval for its debt-cutting plan.

Should Horan bless the plan, Airspan would be able to leave bankruptcy after only about a month under court supervision.

“The quicker we can get out the better,” company attorney Eric Lopez Schnabel told Horan during the court hearing.

The company, based in Boca Raton, Florida, also won initial approval of a $53.9 million loan package from affiliates of Fortress that will refinance some older debt and provide fresh cash to help pay for the bankruptcy case. Airspan will get access to $7.5 million of the cash immediately and must return to court for final approval for the rest.

Founded in 1998, Airspan develops software and hardware for big wireless networks used by industrial customers and other major users who need Internet signals throughout areas that have difficulty getting reception. One of the company’s biggest projects has been to help install wireless technology in New York’s subway system.

In 2021, Airspan merged with a special purpose acquisition company, or SPAC, under a process designed to help a business become publicly-traded more quickly and with fewer regulatory requirements than typically required under an initial public offering of shares. Only about 15% of such deals completed in 2021 have turned a profit.

The case is Airspan Networks Holdings, 24-10621, US Bankruptcy Court, District of Delaware (Wilmington).

(Adds participation of Fortress Investment Group in third and seventh paragraph.)

©2024 Bloomberg L.P.