Oct 19, 2022

Alcoa posts surprise loss as aluminum woes deepen

, Bloomberg News

Alcoa Corp. confirmed investors’ biggest concern of the last couple months: demand for the world’s heavy industries is falling, a warning sign for the broader economy.

The largest U.S. aluminum producer posted a surprising quarterly loss, signaling a worsening environment for a company that just last month warned investors it was being squeezed by higher costs and falling prices for the lightweight metal. Alcoa’s numbers couldn’t even attain Wall Street’s meager profit forecast. Shares fell 1.1 per cent Thursday at 9:40 a.m. in New York.

The Pittsburgh-based company is a dependable barometer of U.S. economic health across industries including construction, automotive, aerospace and consumer packaging due to their intense aluminum consumption. Investors had little time to linger on Alcoa’s worrisome outlook as Nucor Corp. posted earnings results Thursday that missed estimates, with the largest U.S. steelmaker noting that economic uncertainty and inflation are putting pressure across “a myriad” of sectors in the U.S. Nucor’s shares fell 2 per cent.

These results come five weeks after three of the most iconic names in American heavy industry forewarned investors that shipments are waning across all sectors. Since then, inflation deepened to further eat into average Americans’ paychecks and the U.S. Federal Reserve continued to raise benchmark borrowing costs, crushing the housing market.

Nucor forecast “increasingly” challenging market conditions spawned by economic uncertainty heading into the end of the year. The Charlotte-based company told investors to expect “significantly” lower earnings from its steel mills due to lower volumes and metal prices.

“Economic uncertainty and inflation continue to put pressure across a myriad of sectors in the U.S.,” Nucor Chief Executive Officer Leon Topalian said in a rare downtrodden comment.

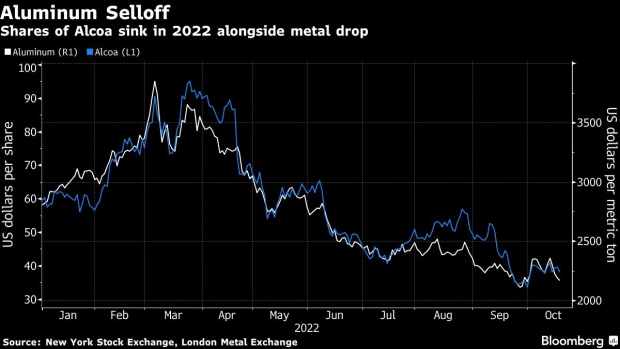

Alcoa is the first of the world’s aluminum giants to report third-quarter results in a challenging year that’s seen a torrent of issues undermining profitability. Prices for the metal are down more than 20 per cent this year as rising global inflation, surging energy costs and weakening economic outlook batter the metal used from toasters and skyscrapers to automobiles. Adding to the market uncertainty is a potential ban of the metal from Russia, the world’s second-largest producer, either by the London Metal Exchange or the U.S.

Alcoa said its loss was due to decline in alumina and aluminum prices, higher energy and raw material costs and restructuring charges, including US$626 million tied to pension settlements, while its executives during Wednesday’s earnings call provided analysts with further details.

“When the CEO said 35 per cent of global capacity was loss-making in September it was an eye opener that this is a cruel operating environment,” Timna Tanners, an analyst at Wolfe Research, said in an email. The results “reflected market conditions that seem completely unsustainable.”