Feb 23, 2023

Alibaba Profit Beats After Cost Cuts Outweigh Sales Malaise

, Bloomberg News

(Bloomberg) -- Alibaba Group Holding Ltd. is pushing aggressive cost-cutting to boost profit as growth in its domestic China market remains anemic, a conservative shift for a tech giant that once spent aggressively to dominate wide swaths of the economy.

The online retailer reported net income rose a better-than-anticipated 69% to 46.8 billion yuan ($6.8 billion), but revenue rose just 2.1% to 247.76 billion yuan in the December quarter, slightly ahead of projections. Alibaba’s shares closed down slightly after climbing 6% in early New York trading.

The anemic sales growth underscores tricky economic conditions after China abolished Covid restrictions in December. Its core Chinese commerce business slid 1% in the quarter — the third straight decline for the unit that underpins the broader empire. Cloud computing revenue, typically one of the company’s fastest-growing divisions, inched up a disappointing 3% to 20.2 billion yuan.

Beijing has cracked down on the country’s tech giants over the last two years, forcing fundamental changes in the business models of companies including Alibaba. The e-commerce pioneer is also navigating increasingly tough competition from arch-rival JD.com Inc. as well as up-and-comers such as PDD Holdings Inc. and ByteDance Ltd.

Persistent declines in business on Alibaba’s commerce platforms “raises the risk that Alibaba will struggle to retain shoppers and merchants if rivals such as JD.com and ByteDance’s Douyin offer them more subsidies in the next 10 months,” Bloomberg Intelligence analysts Catherine Lim and Tiffany Tam wrote after the results.

Some investors worry that a sustained recovery in consumer spending may take time, and any rebound might be slow. At the same time, Chinese internet firms from JD to Meituan and PDD are revving up efforts to outdo each other since Beijing began to wind back a bruising crackdown on the tech sector. That’s spooked investors worried about a resurgence in the margin-eroding price wars of years past.

Executives brushed off concerns Alibaba will join in a market-share grab, arguing instead that fundamental technological changes such as demand for high-performance computing for AI will prop up its bottom line. Executives reiterated they were working on integrating generative AI — the ChatGPT-like technology that’s caught global attention — into various services.

“Price subsidies are nothing new — every couple of days, somebody out there comes up with a bright idea to win more opportunities,” Chief Executive Officer Daniel Zhang told analysts on a conference call. “But if you take a clear-eyed look at history, no player has managed to achieve that kind of turnaround by relying on subsidies. What it takes is technology” innovation.

Once the most valuable company in China, Alibaba is now at risk of looking more like a utility after Beijing launched its sweeping crackdown on the tech industry about two years ago. The government forced Alibaba’s finance affiliate, Ant Group Co., to call off what would have been the world’s largest initial public offering in 2020, and then launched reforms that have undercut Alibaba’s business model.

Though Beijing has begun to unshackle the tech sector, granting Tencent Holdings Ltd. a clutch of game titles and allowing ride-hailing giant Didi Global Inc. to resume signing up new users, an Ant IPO is still up in the air and Alibaba’s plan to move its primary listing to Hong Kong was delayed. Ant contributed 1 billion yuan to Alibaba’s earnings, Thursday’s filing showed.

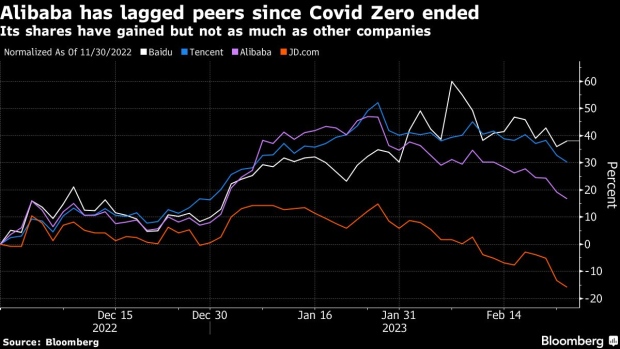

As China’s largest e-commerce company, Alibaba remains a barometer for consumer demand in the country. Its shares have gained more than 10% in 2023 as China’s Covid policy u-turn is expected to galvanize the economy, overall. Nationwide online retail sales rose 7.6% year-on-year in the fourth quarter.

What Bloomberg Intelligence Says:

Alibaba’s steeper-than-expected reduction of international commerce losses, which shrank nearly 75% in fiscal 3Q, raises the likelihood that the segment can break even in the year ending March 2024, assuming Trendyol’s operations in Turkey resume normal operations by September. The scale of such overseas savings can offset hikes in marketing and promotional spending in mainland China as the company seeks to uphold local market share and lift overall margins into 2024, we calculate.

-Catherine Lim and Trini Tan, analysts

Click here for the research.

Read more: Jack Ma-Backed Ant Profit Falls 83% After Regulatory Clampdowns

For now, Alibaba is likely to continue to focus on cost reduction and profitability rather than new business expansions. To achieve what it’s called high-quality growth, the company reduced its workforce by about 19,000 employees last year.

The Hangzhou-based firm faces fierce competition in its home market from JD.com and up-and-coming short video and live streaming platforms such as ByteDance Ltd.’s Douyin and Kuaishou Technology, which have stepped efforts to lure customers and woo merchants.

Overseas, the tech giant is curtailing its global ambitions. Alibaba sold off the last of its shares in Indian fintech giant Paytm this month, accelerating a withdrawal from the world’s fastest-growing mobile and internet arena.

Cost curbs — particularly at its domestic consumer services and international commerce — are set to support Alibaba’s margins in the near term. But longer term, it still has to come up with an answer to the intensifying competition.

With its user growth approaching a ceiling, the company is increasingly focusing on areas such as cloud computing services. After cloud sales — once the company’s biggest driver — notched its slowest-ever pace of growth in the September quarter, Zhang took on the role of acting president of Alibaba Cloud Intelligence and enterprise communications app DingTalk.

“Cloud computing is one of Alibaba’s core strategies for the future,” Zhang said in prepared remarks on the call. “This is a critical period for technological breakthrough and development in this nexus of cloud computing and AI.”

--With assistance from Sarah Zheng, Zheping Huang, Vlad Savov, Lulu Yilun Chen and Peter Elstrom.

©2023 Bloomberg L.P.